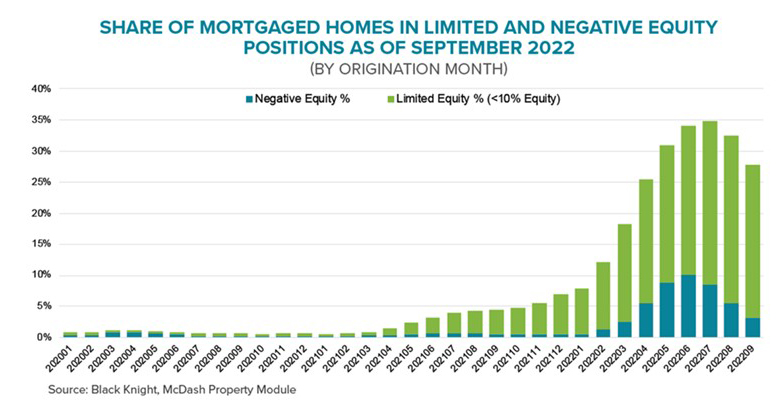

Black Knight: 8% of 2022 Mortgaged Home Purchases Underwater; FHA Loans See Early-Payment Defaults Rise

Black Knight, Jacksonville, Fla., said of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwater and nearly 40% have less than 10% equity stakes in their home, a situation most concentrated among FHA/VA loans.

The company’s monthly Mortgage Monitor report said at just 0.84%, negative equity rates among all mortgaged properties remain extremely low by historical standards. But more than 20% of 2022 FHA/VA purchase mortgage holders have now dipped into negative equity, with nearly two-thirds having less than 10% equity.

Additionally, the report said early-payment defaults – loans delinquent within six months of origination – have been rising among FHA borrowers over the past year and now sit above pre-pandemic levels.

“Though the home price correction has slowed, it has still exposed a meaningful pocket of equity risk,” said Ben Graboske, Black Knight Data & Analytics. “Make no mistake: negative equity rates continue to run far below historical averages, but a clear bifurcation of risk has emerged between mortgaged homes purchased relatively recently versus those bought early in or before the pandemic. Risk among earlier purchases is essentially nonexistent given the large equity cushions these mortgage holders are sitting on.

More recent homebuyers don’t fare as well, Graboske noted: Of the 450,000 underwater borrowers at the end of the third quarter, the mortgages of nearly 60% had been originated in the first nine months of 2022 – and these were overwhelmingly purchase loans. “This is an illustrative and, unfortunately, potentially vulnerable cohort that we will continue to keep a close eye on in the months ahead,” he said.

Black Knight also said while home prices continued to pull back in October, the month’s 0.43% decline (a seasonally adjusted 0.13% decrease) was the smallest seen since prices peaked in June.

The report said annualized appreciation slowed to 9.3% from September’s 10.7%, marking the seventh consecutive month of cooling, but the smallest such decline since May. New for-sale listings in October were 19% (-94,000) below 2017-2019 levels, marking the largest deficit in six years – outside of March and April 2020 when much of the country was in lockdown.