Yardi: E-Commerce Propelling Industrial Sector

(Courtesy Yardi Matrix, Santa Barbara, Calif.)

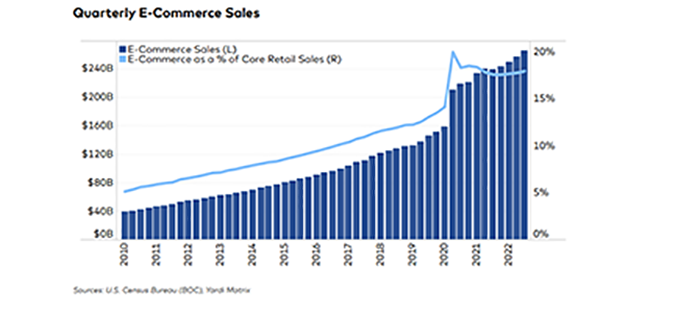

The e-commerce boom that started in 2020 is still propelling the U.S. industrial market, reported Yardi Matrix, Santa Barbara, Calif.

“Firms have spent the last two years trying to adjust to increased online sales,” Yardi said in its December National Industrial Report. “Even as e-commerce sales growth has returned to normal in recent quarters, supply chains have still not fully adapted to the shock that the pandemic created.”

The U.S. Census Bureau said e-commerce sales volume in the third quarter was more than two-thirds higher than in first-quarter 2020.

Industrial space pressures have cooled in recent months, but industrial space remains hard to come by in some key places, the report said. For example, in port and logistics markets, vacancy rates are “minuscule” and competition for space among tenants is fierce, Yardi said.

Amazon grew its warehouse space rapidly last year but pulled back this year and admitted it had been too aggressive, the report noted. “Amazon also has big-box retailers like Target and Walmart to contend with now. These companies were forced to play catch-up to Amazon when the pandemic hit, and have since been attempting to leverage their physical footprints,” Yardi said. “Both retailers have expanded delivery and in-person pick-up options and have begun using their stores as last-mile delivery centers.”

Yardi noted it expects e-commerce growth will continue to drive strong demand in the industrial sector for the near future, though it will not reach 2020 levels again. “New supply has yet to match demand, and even a potential recession is unlikely to cause e-commerce sales volume to fall,” the report said.