BREAKING NEWS

Applications Fall 4th Straight Week in MBA Weekly Survey

Mortgage applications fell for the fourth straight week, remaining at their lowest level in 22 years as interest rates jumped to its highest level since July, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 26.

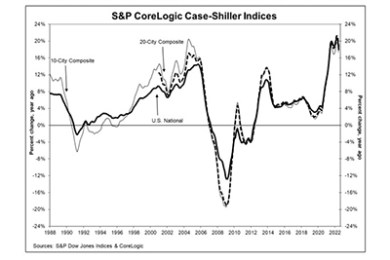

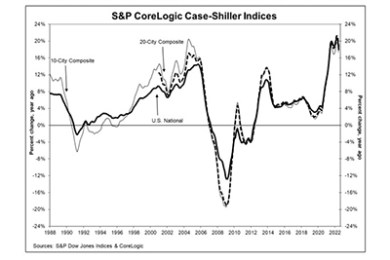

The S&P CoreLogic Case-Shiller Indices reported an 18 percent annual gain in June, still hot but well off the 19.9 percent pace in May. And the Federal Housing Finance Agency also reported deceleration in June, to 17 percent.

Gas prices fell to a four-month low this month; conversely, consumer confidence rose to a four-month high, The Conference Board reported Tuesday.

S&P Global Market Intelligence, New York, reported U.S. public pension funds are increasing their allocations to real estate as a hedge against volatile market conditions.

Sales of homes million dollar-plus homes have more than doubled over the past three years, but as with groceries, buyers are getting less than they used to, said Zillow, Seattle.

With inflation currently at 9.1% and interest rates expected to rise further, reverse mortgages could help senior borrowers with funds for living in place.

WASHINGTON, D.C.—Ginnie Mae President Alanna McCargo will be the first to tell you that “speed” and “innovation” rarely appear in the same sentence with “federal agencies.” But she’d also be the first to tell you that it is possible.

WASHINGTON, D.C.—Property appraisals are at the core of the loan origination process—and the real estate finance industry’s efforts to make the process more efficient, less expensive and fair for all involved.

Natixis Corporate & Investment Banking, New York, originated $76.8 million for Overall Creek Apartments, a 384-unit Class A property in Murfreesboro, Tenn.

Designing the future beyond the current downturn requires a comprehensive examination of what is necessary across digital financial actions—by the consumer, by the investor, by the regulators, and by rising non-traditional competitors. Traditional strategy encased by technology is the norm—but moving forward has this prescription lost its efficacy? Will we adapt—or will we die?

Ellen Comeaux is Senior Vice President and Commercial Division Leader with TIAA Bank, Jacksonville, Fla.

While profit margin compression impacts all lenders, smaller lenders often feel the impact more significantly. These lenders may not have the same resources or volume to bear the impact of squeezed profit margins. The question is, in the face of these obstacles, how can mortgage lenders successfully navigate the margin compression and market volatility wave?

The Mortgage Bankers Association's annual Human Resources Symposium takes place Sept. 8-9 in Arlington, Va.