Housing Market Roundup Aug. 10, 2022: More Home Listings ‘Stale;’ Opportunity Zone Home Prices Lag

Here’s a quick roundup of housing market stories this week:

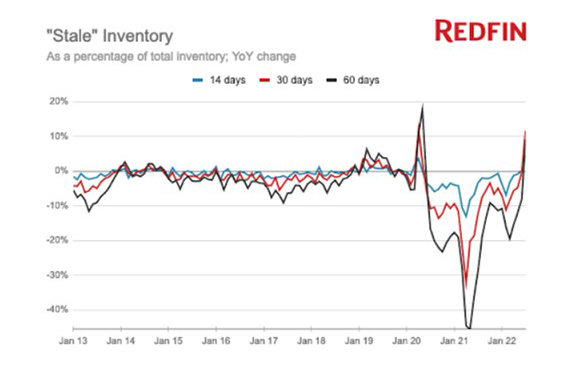

Redfin: Growing Share of Home Listings ‘Stale as Market Cools

Redfin, Seattle, reported the share of U.S. homes listed for 30 days or longer without going under contract increased by 12.5% in July from a year earlier,

The report said 61.2% of for-sale homes were on the market for at least 30 days, up from 54.4% a year earlier. That’s the first year-over-year increase in “stale” housing supply since the beginning of the pandemic and close to the biggest uptick in Redfin’s records, which go back to 2012. The only time it increased more (13.9% YoY) was in April 2020, when the housing market nearly ground to a halt.

Redfin Deputy Chief Economist Taylor Marr said homes staying on the market longer is a reflection of the housing market slowing in response to 5%-plus mortgage rates and a shaky economy. Rates shot up quickly in the first half of 2022, reaching 5.8% in June before dropping slightly to an average of 5.4% in July. It has taken several months of buyers backing off and sellers rushing to list their homes before the market cools further to culminate in inventory piling up.

“People want to know whether we’ve officially shifted from a seller’s market to a buyer’s market. While there’s not a clear line separating those two ideas, homes sitting on the market longer is a point in buyers’ favor,” Marr said. “Buyers can take their time making careful decisions about homes without worrying so much about bidding wars, offering over the asking price and waiving contingencies. It’s a different story for sellers, who have spent the last two years hearing about their neighbors’ homes getting multiple offers the day they go on sale. Now they need to price lower and get back to the basics of selling a home, like staging and sprucing up painting, to get buyers’ attention.”

Oakland, Phoenix, Austin, Anaheim, Riverside, Sacramento and Seattle are among the 20 housing markets that cooled fastest in the first half of 2022.

ATTOM: Opportunity Zone Redevelopment Areas Lag Nationwide Trends

ATTOM, Irvine, Calif., released its second-quarter report analyzing qualified low-income Opportunity Zones targeted by Congress for economic redevelopment in the Tax Cuts and Jobs Act of 2017. The report found median single-family home and condo prices rose from the first quarter to the second quarter in 63 percent of Opportunity Zones around the country and went up at least 5 percent in roughly half of zones analyzed with sufficient data. Typical values also shot up at least 20 percent annually in about half of Opportunity Zones with enough data to analyze across all quarters.

The report also noted median values increased in about half the Opportunity Zones by more than the 8.8 percent quarterly and 15.3 percent year-over-year gain seen for all markets nationwide in the spring. Those gains extended similar patterns seen over the past year as home prices in distressed neighborhoods around the nation continued to keep up with gains in the broader national housing market.

However, the report noted typical home values in Opportunity Zones remained lower than those in most other neighborhoods around the nation in the second quarter. Median second-quarter prices fell below the national median of $346,000 in 77 percent of Opportunity Zones, about the same portion as in earlier periods over the past year. Considerable price volatility also continued in those markets, as median values dropped quarterly in 37 percent of them, probably reflecting the small number of sales in many areas.

“Homes in most Opportunity Zones represent affordable options for real estate investors and consumer homebuyers in a market where both home prices and mortgage rates have been rising,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “With home prices up 15 percent compared to a year ago and mortgage rates nearly doubled, both investors and homebuyers may find the lower purchase prices for homes available in Opportunity Zones very attractive.”