BREAKING NEWS

Senate Democrats Drop MBA-Opposed Carried Interest Provision from Reconciliation Bill

Senate Democrats late Thursday dropped a controversial carried interest provision in a reconciliation bill that the Mortgage Bankers Association and other industry trade groups said would "cripple the housing recovery."

MISMO®, the real estate finance industry standards organization, seeks public comment on three key industry resources to help accelerate the industry’s digital transformation.

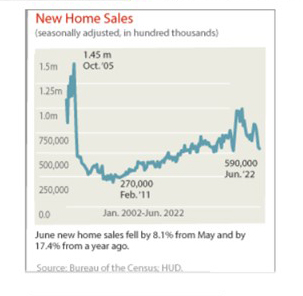

If you build it, they will come; and they’ll bring buying power (and they’ll need it, too).

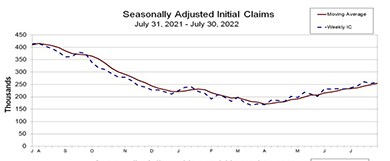

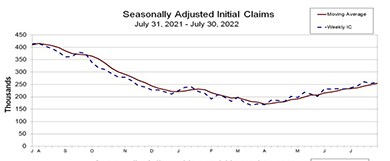

Initial claims for unemployment insurance rose to nearly their highest level this year, ahead of this morning’s unemployment report, the Labor Department said Thursday.

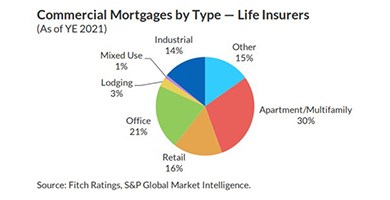

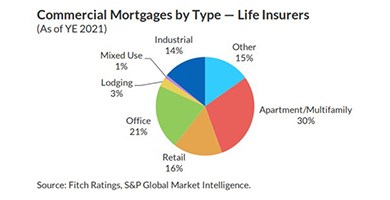

Fitch Ratings, New York, said U.S. life insurers’ commercial mortgage fundamentals have largely recovered since the pandemic, with stable property outlooks for hotel, office retail and multifamily sectors.

Fannie Mae, Washington, D.C., said mortgage lenders appear to be adapting their business priorities to meet what they believe are a new set of challenges, including weakened mortgage demand and rising rates.

NewPoint Real Estate Capital, Plano, Texas, provided a $50.7 conventional Freddie Mac Multifamily loan on behalf of an affiliate of American Landmark LLC to refinance Reunion at 400, a 288-unit community in Kissimmee, Fla.

NewPoint Real Estate Capital, Chevy Chase, Md., promoted Susan Mudry to Chief Operating Officer.

Reimaging of the mortgage markets has begun—driven by shrinking margins, rising rates, and inflationary pressures. Yet, for all the actions since 2010 involving data standards, digital transformations, and customer experiences, what is missing? Who will be left standing as the next cycle takes form and the mortgage industry is digitally reimaged?

Lenders that hunkered down during the last two major industry downturns are no longer in the business, while those that leaned in and innovated during the same period emerged as industry leaders. Now is not the time for timidity. In fact, leading lenders are leaning into innovation now. There are at least three good reasons to do so.

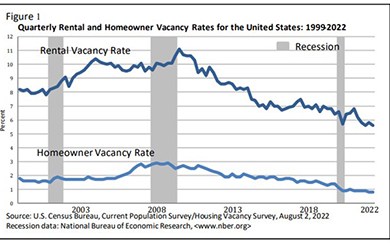

Two years after the height of the COVID lockdown, there’s lots of new data available to prove (or disprove) some of the early predictions and observations regarding home buying patterns and trends.

The Mortgage Bankers Association's annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

The Mortgage Bankers Association is accepting entries for its annual Diversity, Equity and Inclusion Residential Leadership Awards; entry deadline is Friday, Aug. 5.