Multifamily Gives Positive Edge to March Housing Starts

Housing starts improved slightly in March, thanks to a bump in multifamily starts, HUD and the Census Bureau reported Tuesday.

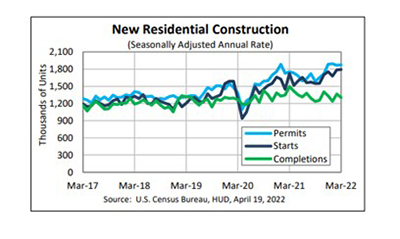

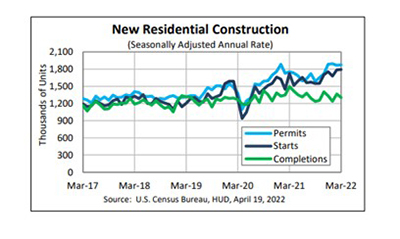

The report said privately owned housing starts in March rose a seasonally adjusted annual rate of 1,793,000, 0.3 percent higher than the revised February estimate of 1,788,000 and 3.9 percent higher than a year ago 1,725,000.

No thanks to single-family, however; the report said single‐family housing starts in March fell to a rate of 1,200,000, 1.7 percent below the revised February figure of 1,221,000. The March rate for units in buildings with five units or more rose to 574,000, 7.5 percent higher than February (534,000) and 28.1 percent higher than a year ago.

Regionally, results were mixed. In the largest region, the South, starts fell by 17.2 percent in March to 834,000 units, seasonally annually adjusted, from 1.007 million units in February and fell by 6.4 percent from a year ago. In the Midwest, starts fell by nearly 3 percent to 232,000 units in March from 239,000 units in February and fell by 19.4 percent from a year ago.

However, starts jumped in the Northeast by nearly 111 percent to 293,000 units in March, seasonally annually adjusted, from 139,000 units in February and improved by nearly 78 percent from a year ago. And in the West, starts rose by nearly 8 percent in March to 434,000 units from 403,000 units in February and improved by nearly 14 percent from a year ago.

“Starts for the prior two months were also revised modestly higher, which puts home building on firmer footing ahead of the recent spike in mortgage rates,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Building permits also rose solidly during the month and the prior month’s total was revised slightly higher. While the revisions lifted both single-family and multifamily starts, much of the upward adjustment was in multifamily units, with starts and permits for apartment projects increasing.”

Vitner said home building “still has plenty of momentum.”

“Expectations had called for a slight drop,” Vitner said. “Not only did housing starts top expectations, but data for the prior two months also were revised higher…the strength in housing starts at the start of 2022 likely reflects some easing in supply constraints that have plagued home builders during the pandemic. While shortages still exist, many builders have found workarounds and many firms have stockpiled key materials. Labor is also more plentiful, as evidenced by the recent strength in construction employment.

However, Vitner suggested while home building has gotten off to a strong start, single-family starts have likely peaked for the year. “With completions picking up, the backlog of single-family homes that have been authorized but have not yet been started appears to be leveling off,” he said. “This is likely a precursor to a modest pullback in single-family starts we expect to take hold over the balance of this year. Even with a pullback, however, the strong start to the year puts single-family starts on pace to easily top last year’s level.”

“Builders continue to face supply chain disruptions that have pushed prices for building materials higher, as well as a shortage of skilled labor, materials and lots that make it difficult to increase the pace of construction,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “In addition to supply chain disruptions, builders are growing concerned about declining affordability. In February 2022, the average 30-year, fixed mortgage rate stood at 3.8% and now it’s above 5%. The increase in rates since February has reduced consumer house-buying power by $60,000.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., noted with mortgage rates now having risen nearly 200 basis points since mid-December, it is only a matter of time before this weighs significantly on housing demand due to worsening affordability. “However, in the near term, due to continued heightened order backlogs, strong gross margins realized by homebuilders, and a lack of existing homes for sale, we expect new home construction to remain resilient,” he said. “We are only expecting a modest decline at this point in housing starts over the second quarter. However, the higher mortgage rates continue to rise, the more this will likely weigh on home construction later this year.”

Building Permits

The report said privately owned housing units authorized by building permits in March rose to a seasonally adjusted annual rate of 1,873,000, 0.4 percent above the revised February rate of 1,865,000 and 6.7 percent higher than a year ago (1,755,000). Single‐family authorizations in March fell to 1,147,000; 4.8 percent below the revised February figure of 1,205,000. Authorizations of units in buildings with five units or more rose to 672,000 in March, up by nearly 11 percent from February and by nearly 34 percent from a year ago.

Housing Completions

The report said privately owned housing completions in March fell to a seasonally adjusted annual rate of 1,303,000, 4.5 percent below the revised February estimate of 1,365,000 and 13.0 percent lower than a year ago (1,497,000). Single‐family housing completions in March fell to 1,000,000; 6.4 percent below the revised February rate of 1,068,000. The March rate for units in buildings with five units or more rose to 292,000, up by 1 percent from February but down by 36.1 percent from a year ago.