March Consumer Prices Jump 1.2%; Up 8.5% from Year Ago

Inflation roared ahead in March, the Bureau of Labor Statistics reported Tuesday, at a clip not seen since 2005.

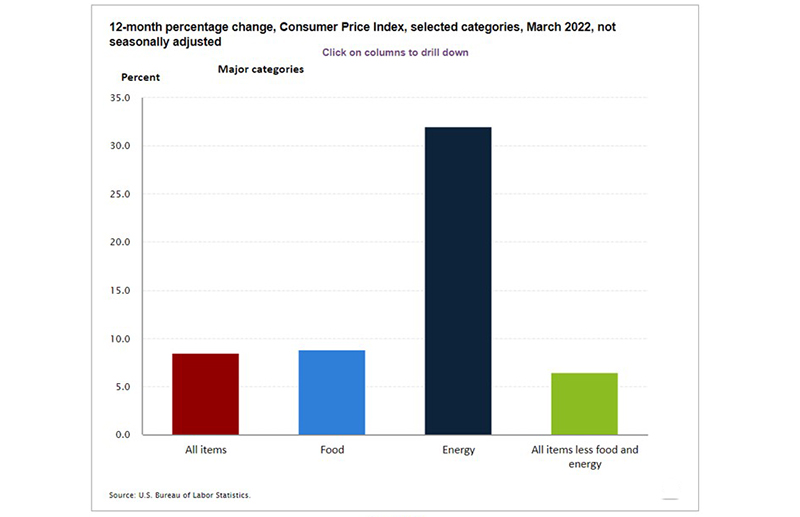

The Consumer Price Index for All Urban Consumers increased by 1.2 percent in March on a seasonally adjusted basis, after rising by 0.8 percent in February. Over the past 12 months, the all-items index increased by 8.5 percent before seasonal adjustment.

Increases in the indexes for gasoline, shelter and food were the largest contributors to the seasonally adjusted all-items increase. The gasoline index rose 18.3 percent in March and accounted for more than half of the all-items monthly increase; other energy component indexes also increased. The food index rose by 1.0 percent and the food at home index rose by 1.5 percent.

The index for all items less food and energy rose by 0.3 percent in March following an 0.5-percent increase the prior month. The shelter index was by far the biggest factor in the increase, with a broad set of other indexes also contributing, including those for airline fares, household furnishings and operations, medical care and motor vehicle insurance. In contrast, the index for used cars and trucks fell 3.8 percent over the month.

The all-items index continued to accelerate, rising 8.5 percent for the 12 months ending March, the largest 12-month increase since the period ending December 1981. The all-items less food and energy index rose 6.5 percent, the largest 12-month change since the period ending August 1982. The energy index rose 32.0 percent over the past year, and the food index increased 8.8 percent, the largest 12-month increase since the period ending May 1981.

“About 70% of March’s increase can be tied to higher energy prices following Russia’s invasion of Ukraine, but energy was not the only source of pain for households,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “The squeeze on households’ from skyrocketing prices for necessities is very real.”

However, House said signs underneath the surface that pandemic-related inflation is beginning to ease, noting core goods inflation fell by the most since April 2020, led by a decline in used auto prices, while core services inflation gathered steam amid higher prices for airfare, lodging away from home and other “reopening” categories.

“This rotation away from goods and toward services inflation has been long anticipated, and although widening lockdowns in China are a risk to this transition, today’s data are an encouraging sign that goods inflation is finally rolling over,” House said. “Despite another month of wide-ranging price increases in March, we believe this likely marks the peak in post-COVID inflation.”

However, House said relief is still a ways off. “We expect headline CPI to still be around 6% on a year ago basis in the fourth quarter, with the quarterly annualized rate still uncomfortably high at around 4%,” she said. “With inflation so far above target, we expect the Fed to expedite tightening and hike the fed funds rate by 50 bps at both the May and June FOMC meetings, in addition to beginning to wind-down the balance sheet in May.”