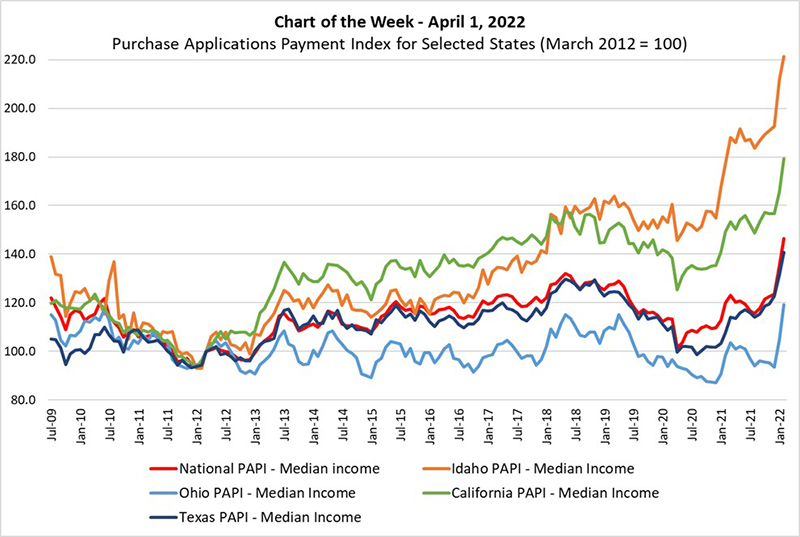

MBA Chart of the Week Apr. 1 2022: MBA Purchase Applications Payment Index

Sources: MBA Weekly Applications Survey and U.S. Bureau of Labor Statistics

On March 24, MBA released its inaugural, monthly Purchase Applications Payment Index (PAPI) – an affordability index that measures how new fixed-rate 30-year purchase mortgage payments vary across time relative to income.

Every month, MBA Research will use MBA Weekly Applications Survey payment data, together with U.S. Bureau of Labor Statistics’ Current Population Survey earnings data, to generate PAPI series for various points in the payment distribution, as well as by loan type, geography, and race. In addition, as part of the PAPI release, we will compare the national WAS payment data to the U.S. Census Bureau’s Housing Vacancies and Homeownership survey’s median asking rent to create MBA’s national mortgage payment to rent ratio.

In this week’s MBA Chart of the Week, we show PAPI series – constructed using median WAS payments and median income – for the nation and for four selected states. Higher index values imply that the mortgage payment to income ratio is higher than in a month where the index is lower, indicating lower homebuyer affordability.

The national series (red line) dipped to 101.5 at the start of the pandemic in April 2020 – just 1.5 points above the March 2012 base of 100. However, in recent months, as median mortgage application amounts increased (from $300,000 in August 2021 to $340,000 in February 2022) and effective note rates rose by over one point (from 3.12% in August to 4.15% in February), the national median PAPI increased from 115.7 to 146.3. In other words, despite earnings increases of around 5%, affordability has eroded in recent months. Moreover, the PAPI increases have accelerated – increasing by 23 points since December.

The increase of the last couple of months is also evident for the four selected states. In Idaho, the PAPI jumped to 221.3 in February.

The latest MBA WAS data for the week ending March 25, released on Wednesday, showed a contract 30-year interest rate of 4.80%. With home-price appreciation running at 18.2% (as reported by the Federal Housing Finance Agency on Tuesday), and tight labor markets, we believe the PAPI will be an important tool for the mortgage industry. MBA’s second PAPI report, the March update, will be released on April 28.

–Edward Seiler eseiler@mba.org.