Home Affordability Gets Tougher as Prices, Rates Surge

MBA NewsLink Staff

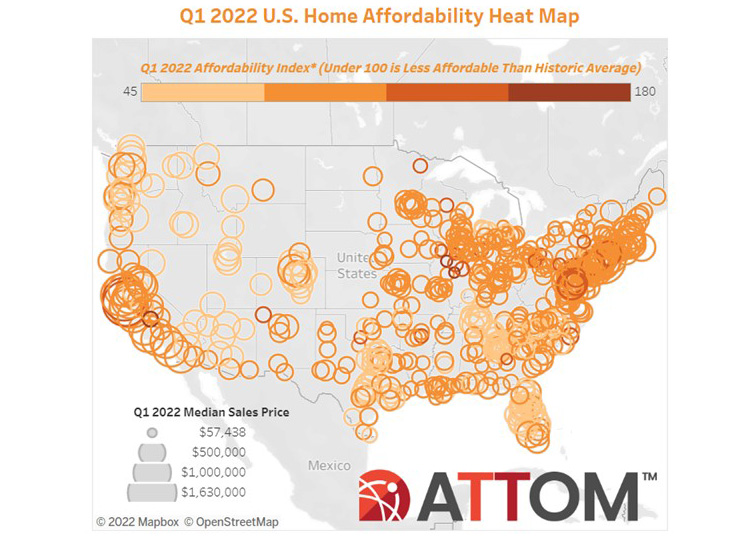

ATTOM, Irvine, Calif., said median-priced single-family homes were less affordable in the first quarter compared to historical averages in 79 percent of counties across the nation.

The firm’s quarterly U.S. Home Affordability Report said that was up from just 38 percent of counties that were historically less affordable a year ago, to the highest point since mid-2008, as home prices continued rising faster than wages in much of the country.

The report determined affordability for average wage earners by calculating the amount of income needed to meet major monthly home ownership expenses — including mortgage, property taxes and insurance — on a median-priced single-family home, assuming a 20 percent down payment and a 28 percent maximum “front-end” debt-to-income ratio.

“It’s certainly no surprise that affordability is more challenging today for prospective homebuyers than it was a year ago,” said Rick Sharga, executive vice president of market intelligence for ATTOM. “Historically low mortgage rates and higher wages helped offset rising home prices over the past few years, but as home prices continue to soar and interest rates approach five percent on a 30-year fixed rate loan, more consumers are going to struggle to find a property they can comfortably afford.”

The report said compared to historical levels, median home prices in 461 of the 586 counties analyzed in the first quarter were less affordable than in the past, up from 449 in the fourth quarter and 224 a year ago.

That increase continued as the median national home price spiked 16 percent, year over year, to a record high of $320,000 while average wages across the country rose just 7 percent.

ATTOM said major ownership costs on median-priced homes around the U.S. did still remain within the financial means of average U.S. workers in the first quarter, consuming 26.3 percent of the $66,560 average national wage. That was within the 28 percent ceiling considered affordable by common lending standards. But it also stood at the highest point since third quarter 2008. It was up from 24.9 percent in the fourth quarter and 21.8 percent in the first quarter– the largest annual increase since at least 2005.

The report said home-price appreciation was greater than weekly wage growth in the first quarter of 2022 in 473 of the 586 counties analyzed in the report (81 percent), with the largest including Los Angeles County; Harris County (Houston); Maricopa County (Phoenix); San Diego County, and Orange County, Calif. “The good news is that in almost half the counties we reviewed, home ownership costs remained below 28% for households with average income,” Sharga said. “But the ‘x-factor’ is what impact 8% inflation rates will have on these households, and their ability to meet their financial obligations. Rising food and energy prices could be a hidden factor that makes affordability even more of a challenge for homebuyers and makes it more difficult to make ends meet for current homeowners.”