2021 Single-Family Property Taxes Rise to $328 Billion

ATTOM, Irvine, Calif., said its 2021 property tax analysis of nearly 87 million U.S. single family homes reported $328 billion in property taxes levied on single-family homes, up 1.6 percent from $323 billion in 2020, but well down from the 5.4 percent increase seen from 2019 to 2020

The increase marked the second smallest rise over the past five years.

Meanwhile, ATTOM reported the average tax on single-family homes in the U.S. in 2021 increased at the smallest pace in the five years, rising just 1.8 percent from $3,719 in 2020 to $3,785 last year. The latest figures resulted in an effective tax rate of 0.9 percent, down from 1.1 percent in 2020.

“It’s hardly a surprise that property taxes increased in 2021, a year when home prices across the country rose by 16%,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “The real surprise is that the tax increases weren’t higher, which suggests that tax assessments are lagging behind rising property values, and will likely continue to go up in 2022.”

The report said effective rates declined in 2021 even as total taxes rose, because home values went up far faster than taxes around the country. Median values spiked by more than 10 percent in most of the U.S., as a glut of home buyers kept chasing a tight supply of homes, pushing the nation’s decade-long market boom onward. The buyer surge continued as home-mortgage rates hovered around 3 percent and many households continued to trade congested areas more susceptible to the two-year-old coronavirus pandemic, for the relative safety and larger spaces offered by houses and condominiums.

The report said despite the national increase in the average property tax of just 1.8 percent from 2020 to 2021, larger gains were seen in 163, or 74 percent, of the 220 metropolitan statistical areas analyzed in the report. That happened as taxes rose far less than the national figure across major metros with populations of at least 1 million last year. Those areas had about three-quarters of the population of all metros in the report, which helped keep the national increase low.

Among metro areas with a population of at least 1 million that had the largest increases in average property taxes last year, were Nashville, Tenn. (up 27 percent); Milwaukee (up 18.6 percent); Baltimore (up 12.3 percent); Grand Rapids, Mich. (up 12.3 percent) and Louisville, Ky (up 11 percent). Major markets with the largest decreases in average property taxes included Pittsburgh (down 35.1 percent); New Orleans (down 20.2 percent); Houston (down 18.7 percent); Dallas (down 12.2 percent) and Austin, Texas (down 7.7 percent).

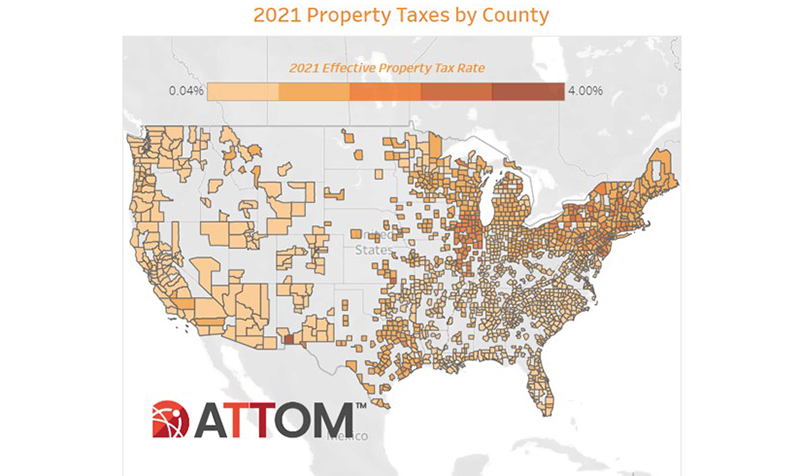

States with the highest effective property tax rates in 2021 were Illinois (1.86 percent), New Jersey (1.73 percent), Connecticut (1.67 percent), Vermont (1.55 percent) and Pennsylvania (1.37 percent). The lowest effective tax rates in 2021 were in Hawaii (0.27 percent), Alabama (0.37 percent), Utah (0.39 percent), Arizona (0.41 percent) and Nevada (0.41 percent).

New Jersey’s average single-family-home tax of $9,476 in 2021 again led the nation. That amount was roughly 10 times more than the average of $901 in West Virginia, which had the nation’s smallest average levy. Others states in the top five last year were Connecticut ($7,464), Massachusetts ($6,777), New Hampshire ($6,698) and New York ($6,617).

Among 220 metropolitan statistical areas around the country with a population of at least 200,000 in 2021, 19 of the 20 highest effective tax rates were in the Northeast and Midwest. Nine of the top 10 were New York, Connecticut and Illinois.

“Prospective homeowners often fail to include property taxes when considering the cost of homeownership,” Sharga said. “But, especially in some of the higher-priced markets across the country, property taxes can add thousands of dollars to annual ownership costs, and possibly be the difference between someone being able to afford a home or not. It’s critically important for consumers to factor in taxes, insurance and maintenance when determining whether they’re ready for the financial responsibility of home ownership.”