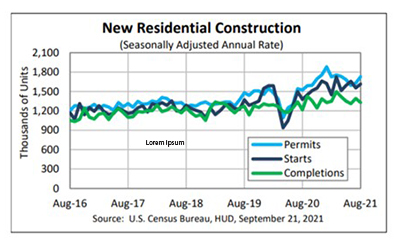

Housing Starts Post Solid August Increase

Home builders liked what they saw in August—HUD and the Census Bureau said August housing starts rose by nearly 4 percent from July, almost entirely by multifamily activity, and by more than 17 percent from a year ago.

The report said privately owned housing starts in August rose to a seasonally adjusted annual rate of 1,615,000, 3.9 percent higher than the revised July estimate of 1,554,000 and 17.4 percent higher than a year ago (1,376,000). Single‐family housing starts in August fell to 1,076,000; 2.8 percent lower than the revised July figure of 1,107,000. The August rate for units in buildings with five units or more jumped to 530,000, up by 21.1 percent from July and by 60.1 percent from a year ago

Regionally, results were mixed–and rather disparate. In the West, starts fell by 21.1 percent in August to 318,000 units, seasonally annually adjusted, from 403,000 units in July and fell by 7 percent from a year ago. In the Northeast, however, starts leapt by a staggering 167.2 percent in August to 179,000 units from just 67,000 units in July; from a year ago, starts in the Northeast more than doubled by 105.7 percent.

In the largest region, the South, starts rose by 1.4 percent to 912,000 units, seasonally annually adjusted, from 899,000 units in July and improved by 29.2 percent from a year ago. In the Midwest, starts rose by 11.4 percent to 206,000 units in August from 185,000 units in July but fell by 14.5 percent from a year ago.

“Housing starts easily topped expectations in August,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Multifamily units accounted for all the strength in starts, reflecting strong demand for apartments.”

Vitner said the drop in single-family starts “has more to do with supply shortages than weakening demand, however. Builders are increasingly having to limit sales, as they are uncertain when they will be able to complete homes due to ongoing shortages of essential building materials.”

Vitner added builders are working on the problem. “The number of single-family homes under construction rose 1.6% in August to 702,000, with most of the gain coming in the South,” he said. “Permits for single-family home rose 0.6% in August to a 1.054 million-unit pace. While that is slightly below the pace of starts, we expect single-family construction to increase this fall.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said home builder sentiment remains on solid footing, “despite concerns that higher new home prices may be causing some would-be buyers to pull back from the market.”

“Builders continue to battle supply-side constraints, including a shortage of skilled labor, materials and lots, all headwinds to increasing the pace of new home construction that is necessary to alleviate the supply shortages in today’s housing market,” Kushi said. “The bottom line is the housing market has been underbuilt for a decade and builders can’t close the gap between supply and demand overnight, but they are trying. Yet, strong supply-side headwinds remain. Many existed even prior to the pandemic, but worsened during the pandemic.”

Mark Palim, Deputy Chief Economist with Fannie Mae, Washington, D.C., noted while single-family starts remain below their recent peak hit in December 2020, the broader trend in recent months is holding steady at a pace that is still more than 20 percent higher than the 2019 pre-COVID average.

“Continued strong house price appreciation and limited supply of existing homes for sale should continue to drive demand for new homes going forward,” Palim said. “The pace, however, will be limited by the speed at which current materials and labor constraints are alleviated.”

Building Permits

The report said privately owned housing units authorized by building permits in August rose to a seasonally adjusted annual rate of 1,728,000, 6 percent higher than the revised July rate of 1,630,000 and 13.5 percent higher than a year ago (1,522,000). Single‐family authorizations in August rose to 1,054,000; 0.6 percent higher than the revised July figure of 1,048,000. Authorizations of units in buildings with five units or more jumped to 632,000 in August, up by nearly 20 percent from July and by nearly 53 percent from a year ago.

Housing Completions

Privately owned housing completions in August fell to a seasonally adjusted annual rate of 1,330,000, 4.5 percent below the revised July estimate of 1,392,000, but 9.4 percent higher than a year ago (1,216,000). Single‐family housing completions in August rose to 971,000; 2.8 percent higher than the revised July rate of 945,000. The August rate for units in buildings with five units or more fell to 356,000, down by nearly 18 percent from July but up by 14.1 percent from a year ago.