BREAKING NEWS

Applications Fall in MBA Weekly Survey

With refinance applications and purchase applications moving in different directions, overall mortgage application activity fell last week as interest rates held steady, the Mortgage Bankers Association reported Wednesday in its Weekly Applications Survey for the week ending Aug. 27.

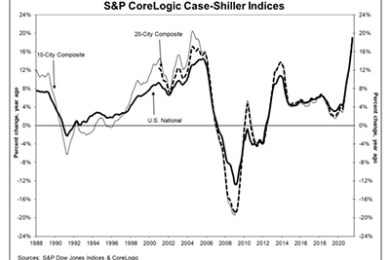

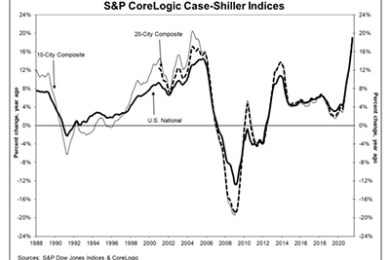

If home prices are cooling off, it’s not evident in the numbers: reports from S&P Dow Jones Indices and the Federal Housing Finance Agency show home prices with annual gains of nearly 20 percent.

The Conference Board, New York, said its Consumer Confidence Index fell for the second consecutive month to its lowest level since February.

Activity in the 12 largest U.S. office markets indicates many have started their recovery from the pandemic-induced downturn, reported CBRE, Dallas.

On June 30, the Federal Financial Institutions Examination Council issued a new booklet. We identified critical guidelines from the new booklet that will introduce fresh challenges to your financial institution.

Newmark, New York, arranged $627.5 million in financing for GID Investment Advisers for a nine-property multifamily portfolio across California, Washington, Massachusetts and Georgia.

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance remained

unchanged at 3.25% as of August 22. MBA estimates 1.6 million homeowners are in forbearance plans.

MBA CONVERGENCE presents the next in its Webinar Series, Mayors and Affordable Housing: Perspective from City Hall, on Thursday, Sept. 16 from 1:30-2:15 p.m. ET.

For years, mortgage underwriters have been accustomed to working from home a few days a week; consequently, during the pandemic, it was not much of a challenge to transition to a 100% remote working scenario. What has been a challenge is managing these highly-skilled employees and maintaining their morale at the same time. The great news is that it can be done.

Tim Anderson is EVP and Director of eMortgage Strategy for Evolve Mortgage Services, where he is responsible for overseeing deployment of the company’s end-to-end digital closing platform and developing strategic partner relationships.

The Mortgage Bankers Association introduces a new offering to its members -- the Diversity, Equity and Inclusion (DEI) Study -- separately designed and compiled for both the residential and commercial/multifamily sides of the real estate finance industry.

mPowering You, MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 16 at the San Diego Convention Center just ahead of the MBA Annual Convention & Expo (Oct. 17-20).