Zillow: Housing Market Moderation Gives Buyers Breathing Room

Zillow, Seattle, said the housing market’s modest calming, which began late in the summer, continued into early fall.

The company’s latest market report said buyers are finding slightly more selection, more price cuts and a bit more time to evaluate a home before it goes under contract.

“The housing market continued its gradual return to some semblance of normalcy in September, helped by the typical seasonal cooldown in shopping conditions that we expect to see every fall,” said Jeff Tucker, Senior Economist with Zillow. “Homes are still selling quickly and prices have not receded, but it’s not quite as extreme a sellers’ market as we saw back in the spring and summer.”

Tucker said buyers today should benefit from a little more time to pick the right home and a few more listings to choose from.

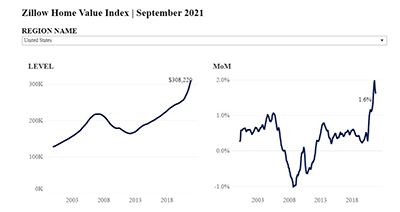

The Zillow Home Value Index for the U.S. rose to $308,220 in September, up 1.6 percent from August. That represented the second straight slowdown after monthly appreciation peaked this year at 2 percent in July. Monthly home value appreciation slowed from August in 44 of the 50 largest U.S. metros. Monthly growth in these markets ranged from a low of 0.4 percent in San Jose to 3 percent appreciation in Raleigh, N.C.

Despite the modest cooling, September marked the fourth-fastest monthly pace of appreciation and a record pace of yearly appreciation in Zillow data dating back to 2000. The typical U.S. home was worth 18.4 percent more this September than in September 2020, surpassing August’s then-record of 17.5 percent year-over-year appreciation. Annual appreciation in large markets was in the double digits across all 50 major markets, ranging as high as an eye-watering 44.9 percent in Austin and 32.2 percent in Phoenix to a comparatively “sluggish” 13.2 percent rate in New Orleans, Zillow said.

Returning inventory

The inventory shortage remains acute in much of the country, down nearly 20 percent from this time a year ago and 37.7 percent below 2019 levels. But slow, incremental growth in inventory is helping shift the scales ever so slightly in buyers’ favor after hitting a record low in April, the report said.

For-sale inventory crept up 0.4 percent from August, roughly matching pre-pandemic seasonal patterns in which inventory usually peaked for the year in August or September. This is the first month in which the year-over-year inventory deficit was smaller than 20 percent since July 2020.

Looking forward, Zillow said it expects 13.6 percent home value growth through September 2022. This is a stronger 12-month forecast than last month, supported by a slower inventory recovery and heightened sales and mortgage application activity. Existing home sales are expected to reach 6.04 million in 2021, up 7 percent from an already strong 2020 and higher than prior forecasts.

Rental rebound echoes price boom

Much like home appreciation, monthly rent growth in the Zillow Observed Rent Index slowed to 1.3 percent, down from recent highs of 2 percent in July and 1.5 percent in August. Rent growth cooled from August to September in 39 of the 50 largest U.S. metros, and rent prices fell in Kansas City and San Francisco.

Annually, typical U.S. rent is up $213 year-over-year to $1,888, Zillow said. The 12.9 percent annual increase is the highest in Zillow records dating back to 2015. Rents rose annually in all 50 of the largest metros, with Sun Belt destinations Tampa (25.7 percent), Las Vegas (25.7 percent) and Phoenix (25.6 percent) topping the list.