BREAKING NEWS

MBA Forecasts Record $1.7 Trillion in 2022 Purchase Originations; MBA Elects Kristy Fercho as 2022 Chairman

SAN DIEGO—The Mortgage Bankers Association swore in Kristy Fercho, Executive Vice President and Head of Home Lending with Wells Fargo, as MBA 2022 Chairman on Sunday during the association’s 2021 Annual Convention & Expo.

SAN DIEGO--The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

Last Tuesday, the House passed a short-term debt ceiling extension, and President Biden signed the bill into law Thursday. The temporary increase in the debt limit will allow the U.S. Treasury Department to continue funding the government’s financial obligations through December 3.

![]()

SAN DIEGO—The Mortgage Bankers Association on Sunday swore in its Board of Directors for the 2022 membership year at its 2021 Annual Convention & Expo.

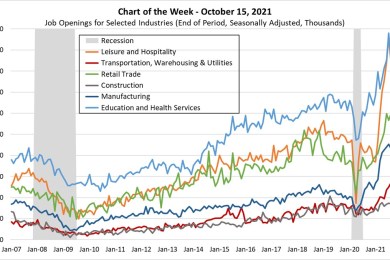

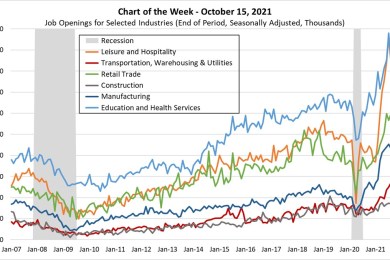

The U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) data for August continues to show that many employers are running into difficulty re-hiring and filling open positions.

![]()

S&P Global Ratings said it plans several initiatives about how it assesses environmental, social and governance factors across all sectors globally.

SAN DIEGO—MBA Annual21, the Mortgage Bankers Association’s Annual Convention & Expo, kicks off in earnest this morning with a full slate of keynote addresses, general sessions, breakout sessions and special events.

Gantry, San Francisco, secured $31 million to refinance the Northgate Plaza Shopping Center in Thousand Oaks, Calif. near Los Angeles.

The case for considering a mortgage loan applicant’s rent history is compelling. Limited credit history disqualifies many renters ― even those with great rent payment history — from homeownership, and multiple studies confirm that factoring in rent payment history typically increases credit scores.

Our own industry has embraced diversity, equity and inclusion efforts at a rapid rate over the past several years. At the same time, we only have to look around ourselves to see that we still have a long way to go, especially at the leadership and boardroom level.

Dave Parker is Chief Product Officer for LoanLogics, a Jacksonville, Fla.-based provider of loan quality technology for mortgage manufacturing and loan acquisition.

The truth is, there is magic in thinking big, especially for the mortgage industry and especially now. In fact, viewing the industry with a new perspective can only benefit lenders in this changing market.

The pandemic was a major lesson that taught businesses to stay prepared for the uncertain future. So, let’s get into the minds and hearts of the lenders and borrowers, and identify which factors could help sustain the lending business in the coming decade.

We must remember to encourage people to buy homes they can afford and educate them on the costs that go with owning a home. That includes advising consumers not to borrow as much money as they possibly can, lest they become “house poor” and miss out on being able to create a more financially secure future for themselves and their families.