Tech Industry Expands Office-Leasing Activity

CBRE, Dallas, said the technology industry led a rebound in U.S. office-leasing activity this year, fueled by increased hiring and demand for tech products and services.

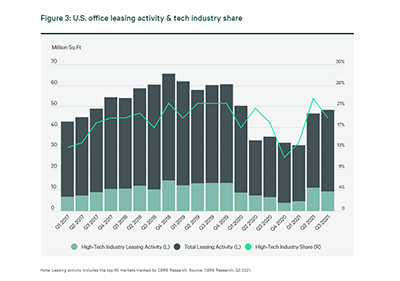

Tech companies’ office leasing activity increased by 122 percent on average in the second and third quarters from the first quarter. The annual CBRE Tech-30 report said technology companies claimed 22 percent of U.S. office-leasing activity in the second and third quarters combined, up from 17 percent in 2020.

In addition, more than two-thirds of the top 30 North American tech markets saw office-rent growth compared to before the pandemic. Over a two-year period (2019-2021), four markets posted double-digit percentage office rent increases: Seattle, Charlotte, Vancouver (B.C.) and Austin. Separately, six markets posted net absorption gains since mid-2019: Charlotte, Raleigh-Durham, Nashville, Salt Lake City, Indianapolis and Phoenix.

“Over the past year, the tech industry has proven to be a resilient industry that grew throughout the pandemic,” said Colin Yasukochi, Executive Director of the CBRE Tech Insights Center. “Many tech companies are, like other industries, embracing hybrid work formats to provide their employees flexibility. But the industry also values the collaborative environment of the physical office and its role in bringing employees together to foster innovation.”

The report noted U.S. tech employment now exceeds its pre-crisis level by 3.3 percent, surpassed only by the life sciences industry’s 6.9 percent employment growth. The tech industry has expanded by 219,000 jobs in the U.S. since May 2020. The top markets for tech-job growth in 2019 to 2020 included Toronto (a 26 percent gain), Seattle (22 percent), Vancouver (21 percent), New York (18 percent) and Austin (16 percent).

But the tech industry still poses a challenge for office markets in one regard: sublease space. Office space listed for sublease by tech companies in the markets tracked by the Tech-30 report nearly doubled from last year’s first quarter to this year’s third, now totaling 134 million square feet. Tech companies currently account for 23 percent of all office space listed for sublease in those markets, up from 14 percent in 2019. “Still, indicators of leasing activity show that the U.S. total of sublease space likely peaked last quarter,” the report said.