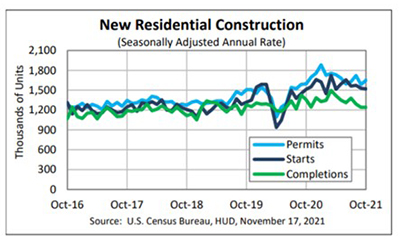

Housing Starts Fall 3rd Straight Month

Housing starts fell for the third straight month in October, HUD and the Census Bureau reported Wednesday, although multifamily starts picked up, as did housing permits.

The report said privately owned housing starts in October came in at a seasonally adjusted annual rate of 1,520,000, 0.7 percent below the revised September estimate of 1,530,000, but 0.4 percent higher than a year ago (1,514,000). Single‐family housing starts in October fell for the fourth straight month to 1,039,000, 3.9 percent below the revised September figure of 1,081,000. The October rate for units in buildings with five units or more rose to 470,000, up by nearly 7 percent from September and by nearly 40 percent from a year ago; multifamily units under construction are at their highest level in 47 years.

Regionally, only the Midwest posted gains, with starts increasing by 5.6 percent in October to 226,000 units, seasonally annually adjusted, from 214,000 units in September. From a year ago, starts in the Midwest increased by 8.7 percent.

In the South, starts fell by 1 percent to 792,000 units, seasonally annually adjusted, in October from 800,000 units in September and fell by 5.7 percent from a year ago. In the West, starts fell by 3.3 percent to 383,000 units in October from 390,000 in September and fell by 0.5 percent from a year ago. In the Northeast, starts fell by 0.8 percent to 122,000 units in October from 123,000 units in September but improved by 45.2 percent from a year ago.

“Residential construction continues to run at a strong pace, although procuring materials and labor continues to weigh on starts,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Apartment developers are moving forward with projects amid a widespread resurgence in demand as COVID concerns lessen, urban amenities reopen and the return to the office progresses.”

“Homebuilder sentiment remains on solid footing, despite affordability concerns, material shortages and other supply-side headwinds—labor, lots and land,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Sentiment remains solid because rates remain near historic lows, rising household income and household formation among millennials continue to fuel demand for homes.”

Building Permits

The report said privately owned housing units authorized by building permits in October rose to a seasonally adjusted annual rate of 1,650,000, 4 percent higher than the revised September rate of 1,586,000 and 3.4 percent higher than a year ago (1,595,000). Single‐family authorizations in October rose to 1,069,000; 2.7 percent higher than the revised September figure of 1,041,000. Authorizations of units in buildings with five units or more rose to 528,000 in October, up by 6.5 percent from September and by 34 percent from a year ago.

“Builders continue to push forward despite the headwinds brought on by intensifying labor and building material shortages,” Vitner said. And Kushi noted the uptick in permits is a “good sign that home building is beginning to accelerate to keep up with the pace of household formation.”

“However, we have underbuilt new housing relative to demand for years,” Kushi said. “Building will have to exceed household formation for some time to reduce the housing stock ‘debt’ we have accumulated. If you build it, they will buy it, and builders are taking heart. With demand for new homes still high, homebuilder confidence in the market for single-family homes rose in November. Yet, headwinds remain.”

Housing Completions

The report said privately owned housing completions in October were unchanged from September at a seasonally adjusted annual rate of 1,242,000, but 8.4 percent lower than a year ago (1,356,000). Single‐family housing completions in October fell to 929,000; 1.7 percent lower than the revised September rate of 945,000. The October rate for units in buildings with five units or more rose to 302,000, up by 4 percent from September but down by nearly 32 percent from a year ago.