BREAKING NEWS

Coverage of the MBA National Advocacy Conference; Applications Up in MBA Weekly Survey

Three members of the Senate Banking Committee visited the Mortgage Bankers Association’s National Advocacy Conference to talk about renewed interest in housing priorities in the 117th Congress.

Mortgage applications rose for the first time in three weeks from one week earlier as interest rates dropped to three-month lows, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 7.

Three senior lawmakers--two retired, one retiring from Congress--stopped by MBA’s National Advocacy Conference yesterday to weigh in on housing, the economy and lessons learned.

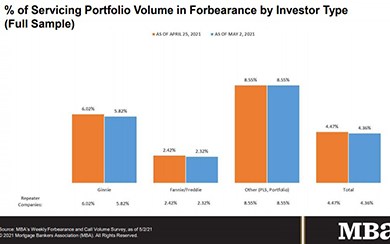

The Mortgage Bankers Association and the National Mortgage Servicing Association asked the Consumer Financial Protection Bureau to make several changes to its proposed rulemaking to amend Regulation X servicing rules.

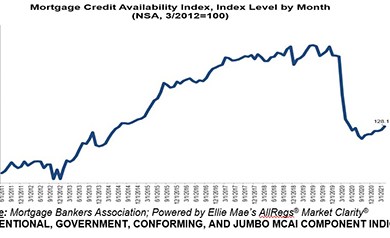

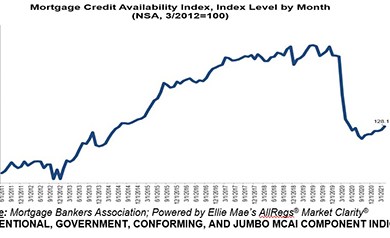

Mortgage credit availability increased in April, the Mortgage Bankers Association reported this morning.

To determine what products, programs and services are needed to address their most urgent pain points, WFG asked its customers and colleagues.

The Mortgage Bankers Association presented its annual Burton C. Wood Legislative Service Award to John Fleming, Counsel of the Law Offices of John Fleming, and General Counsel of the Texas Mortgage Bankers Association.

(One in a recurring series about MBA CONVERGENCE, the Mortgage Bankers Association’s affordable housing initiative.)

Phillips Realty Capital, Bethesda, Md., arranged $58 million in debt and equity for St. Joseph Apartments, a planned 268-unit apartment property in Upper Marlboro, Md.

MBA NewsLink interviewed Justin Latorre, Managing Director of Auction Services at LightBox, about trends he sees at a leading auction platform for commercial real estate assets.

As it typically happens with a new presidential administration, there’s a new attitude in Washington toward the housing market. And one of the most significant changes has been the CFPB’s recent decision to roll back flexibility when reporting Home Mortgage Disclosure Act data. But are lenders ready?

There are no easy answers to be found for legacy banks and those looking to grow their presence in the broader mortgage market, but the clue perhaps lies in the friction involved in existing mortgage processes.

MBA NewsLink recently posed questions about the LOS space to JP Kelly, president and co-founder of OpenClose, a West Palm Beach, Fla. multi-channel, end-to-end LOS and mortgage technology provider.