BREAKING NEWS

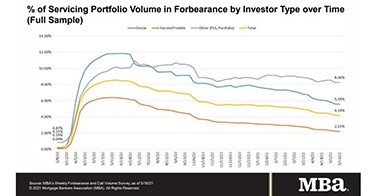

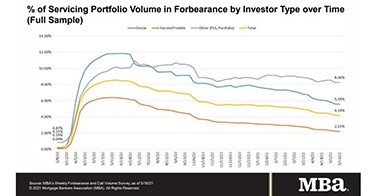

MBA: Loans in Forbearance Fall for 12th Straight Week

Mortgage loans in forbearance fell for the 12th consecutive week, the Mortgage Bankers Association reported Monday.

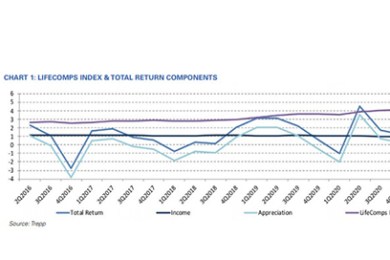

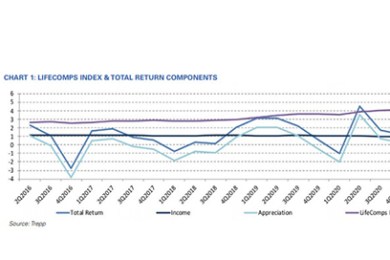

Trepp, New York, said commercial mortgage investments held by life insurance companies dipped in the first quarter after three consecutive positive quarters.

A panel of 42 real estate economists said commercial real estate is “poised for a rebound,” the Urban Land Institute reported.

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

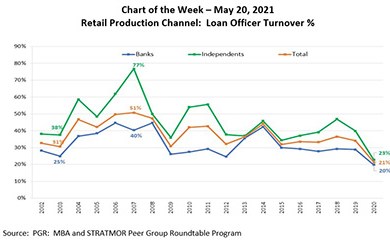

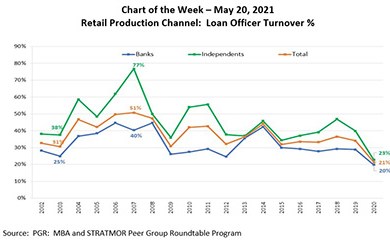

This week’s chart shows the historical retail Loan Officer turnover rates (%) for depository banks and independent mortgage companies, based on data collected through the MBA and STRATMOR Peer Group Roundtable Program, now in its 23rd year of production.

The largest risk in the real estate lending industry is the collateral securing the loan. Having thorough appraisal and evaluation programs in place is the best insurance to mitigate that risk. ServiceLink’s Laura Raposo explains how lenders can identify and select an AMC with an affirmed commitment to compliance, and the financial strength and stability to adhere to that commitment.

New York Life Real Estate Investors originated $154.2 million for industrial and multifamily assets in Virginia and Georgia.

In early May I surveyed 33 senior executives from 33 separate mortgage companies about a myriad of issues and topics both germane and important to the mortgage banking industry. It was the 25th time such a survey was conducted by me since 2008. Until 2020 the surveys were conducted face to face at the MBA National Secondary Market Conference every May and again in October at the MBA’s Annual Convention. However, the pandemic has shifted both sets of contacts to the telephone last year and this.

Notarize, Boston, announced Roger W. Ferguson Jr., joined its board of directors. His career spans more than four decades, including 13 years as CEO of TIAA.

Peter Muoio is head of SitusAMC’s Insights division, a provider of technology and services to the real estate finance industry. He has more than 30 years of research and analytics experience in the commercial real estate industry.

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that equips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations. He founded LenderClose in 2015.

Joe Zeibert is Managing Director of Global Lending Solutions with Nomis Solutions, Brisbane, Calif. He works closely with clients around the world to identify new mortgage and other consumer lending opportunities.

One third of the way into 2021 we find ourselves immersed in questions and wonderment as to what the future of the residential finance business will look like. Originators join with servicers, investors, and borrowers all wondering what comes next. What does our future hold?