BREAKING NEWS

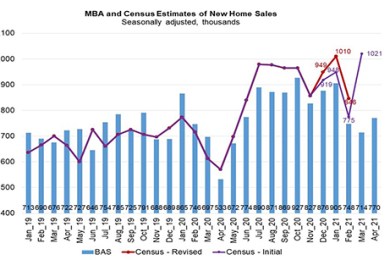

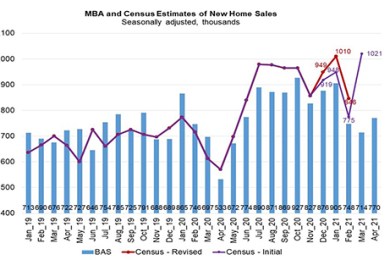

April MBA Builder Applications Survey Down 9% from March, Up 31% from Year Ago

The Mortgage Bankers Association’s monthly Builder Applications Survey posted strong annual gains in April, as the spring homebuying season shifted into full gear.

It’s a great time to be a homeowner: ATTOM Data Solutions, Irvine, Calif., said home equity rose sharply in the first quarter, with equity-rich properties in the U.S. outnumbering seriously underwater homes by a 7-1 margin.

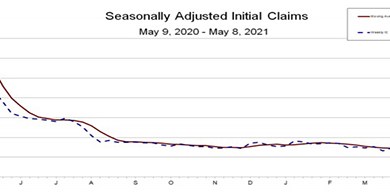

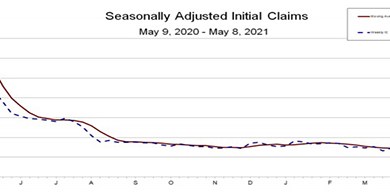

Initial claims for unemployment insurance continued its positive trend downward, falling well under 500,000 for the second week in a row, the Labor Department reported Thursday.

Commercial real estate executives are once again bullish about the U.S. CRE market after an uncertain 2020, DLA Piper's Global Real Estate Annual State of the Market Survey reported.

![]()

The Mortgage Bankers Association presented its annual Burton C. Wood Legislative Service Award to John Fleming, Counsel of the Law Offices of John Fleming, and General Counsel of the Texas Mortgage Bankers Association.

To determine what products, programs and services are needed to address their most urgent pain points, WFG asked its customers and colleagues.

Dwight Capital, New York, closed $178 million in financings for senior living, mixed-use and multifamily properties.

Mortgage servicing has certainly seen ups and downs over the years, although nothing compares to the level of upheaval that we saw last year—nor the speed at which it occurred. Out of the chaos, however, new opportunities to excel have emerged, and perhaps the biggest one of all has been the ability to run a remote workforce with success.

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

The plethora of aaS over the past decade has within their silos been nothing short of a disruptive phase shift of hardware, network, data, and software consumption. However, what happens when these aaS offerings are merged, stacked, and branched to arrive at containers of agility and innovation all serving rapidly evolving customers and their expectations of how finance should be conducted?

As it typically happens with a new presidential administration, there’s a new attitude in Washington toward the housing market. And one of the most significant changes has been the CFPB’s recent decision to roll back flexibility when reporting Home Mortgage Disclosure Act data. But are lenders ready?

MBA NewsLink interviewed Justin Latorre, Managing Director of Auction Services at LightBox, about trends he sees at a leading auction platform for commercial real estate assets.

MBA NewsLink recently posed questions about the LOS space to JP Kelly, president and co-founder of OpenClose, a West Palm Beach, Fla. multi-channel, end-to-end LOS and mortgage technology provider.