BREAKING NEWS

MBA: Loans in Forbearance Fall to 5.05%

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

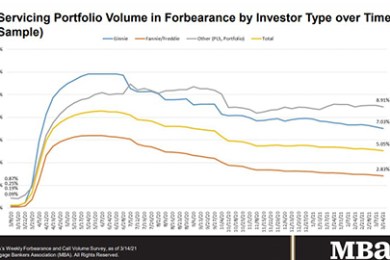

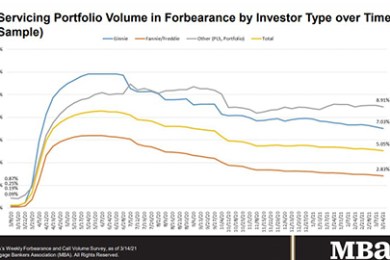

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance fell by 9 percent to 5.05% of mortgage servicers' portfolio volume as of March 14 from 5.14% the week earlier--the lowest level in nearly a year. MBA estimates 2.5 million homeowners are in forbearance plans.

Existing home sales declined in February, following two prior months of gains, the National Association of Realtors reported yesterday.

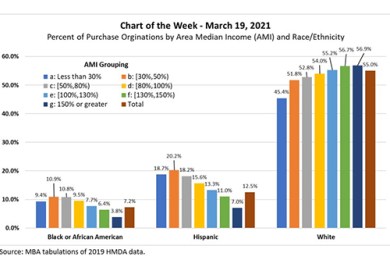

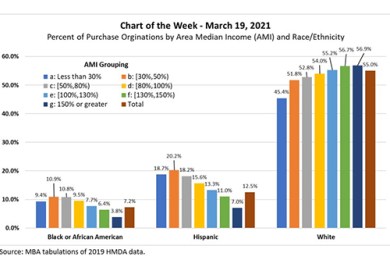

We analyzed the 2019 Home Mortgage Disclosure Act data for the 30 largest metropolitan statistical areas to understand the distributions of first lien mortgage purchase originations by Area Median Income and by race/ethnicity.

With more than half of home sales in many U.S. markets seeing multiple offers, one strategy seems to be working in winning the bidding war—cold, hard cash.

The MBA Opens Doors Foundation announced a new alliance with The Children's Hospital at Saint Francis in Tulsa, Okla. The alliance is the Foundation's first in Oklahoma and brings the number of children's hospitals in its network to 13.

Eastern Union, New York, secured a $57 million bridge financing package for two skilled-care facilities in Florida and two in Massachusetts. The facilities house 544 beds in total.

With the benchmark 30-year fixed rate beginning to creep higher, however, we may start to face a new reality. That’s why smart originators are already thinking about how to generate business when the refi dust settles. And many are setting their sights on the real estate investor channel, because the opportunities for business growth are incredible.

Unlike the NCAA basketball tournament, March Madness in the mortgage industry began very early in March and will last beyond the NCAA Championship game on April 5. By adjusting their application best practices and keeping a keen eye out for upsets for the next few months, lenders can stop upsets before they happen and avoid a busted bracket.

MBA NewsLink interviewed MBA Associate Vice President of Commercial/Multifamily Sharon Walker, who represents MBA members active in multifamily finance. She advocates on policy issues primarily related to Fannie Mae, Freddie Mac and the Federal Housing Administration and oversees numerous related committees, working groups, councils and events.

Today’s customers live online and expect relevant, personalized content and messaging that resonates with their individual wants and needs. That leaves plenty of opportunity for lenders to connect with this massive cohort by providing value and education.

Lenders hiring their way through spikes in volume, as they have for decades, is a suboptimal, efficiency-draining reaction — not a strategic business decision. Any time lenders hire to manage temporary spikes in volume they reduce profitability, add enterprise risk and pour valuable internal resources into a hiring-firing routine that can destabilize and discourage an entire organization long after volume has normalized.

On Monday, HUD finalized updated forms in the FHA Single-Family Condo approval process. On Tuesday, the Senate Banking, Housing, and Urban Affairs Committee held the first of what is expected to be a series of oversight hearings on housing policy this year. And on Thursday, MBA submitted feedback to FHA in response to ML 2021-05, which extends the foreclosure and eviction moratorium and expands the use of FHA’s COVID-19 Loss Mitigation options.