BREAKING NEWS

MBA: Share of Loans in Forbearance Falls to 5.14%; MBA Builder Applications Survey Up 9.2% From Year Ago

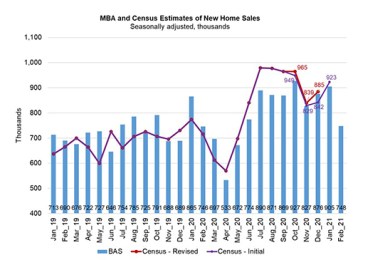

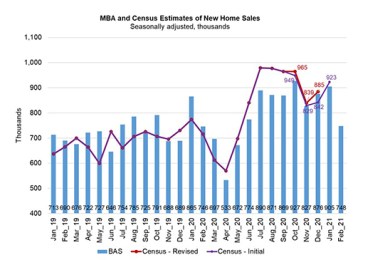

The Mortgage Bankers Association Builder Applications Survey data for February show mortgage applications for new home purchases increased 9.2 percent from a year ago, but fell by 9 percent from January, unadjusted for typical seasonal patterns.

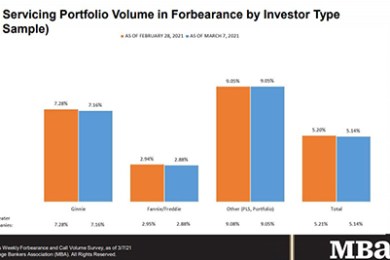

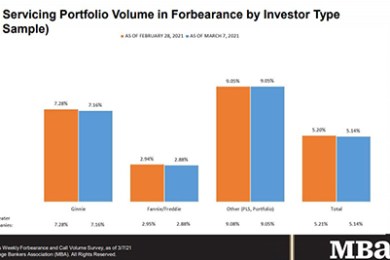

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 5.14% of servicers’ portfolio volume as of March 7 from 5.20% the prior week. MBA estimates 2.6 million homeowners are in forbearance plans.

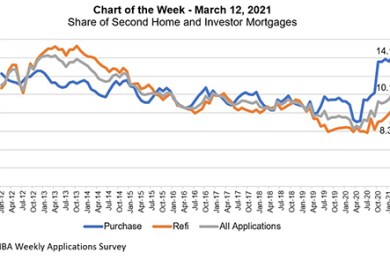

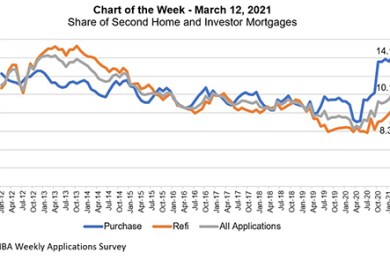

The Mortgage Bankers Association said it is concerned over new limits on loan deliveries for second homes and investor properties by Fannie Mae and Freddie Mac.

Sen. Pat Toomey, R-Pa., ranking member of the Senate Banking Committee, yesterday released a set of guiding principles for housing finance reform, a move welcomed by the Mortgage Bankers Association.

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property.

See How eCBSV is faster, cheaper, less error-prone and requires less manual work.

Grandbridge Real Estate Capital, Charlotte, N.C., closed student housing and seniors housing transactions totaling $112.6 million.

Lenders hiring their way through spikes in volume, as they have for decades, is a suboptimal, efficiency-draining reaction — not a strategic business decision. Any time lenders hire to manage temporary spikes in volume they reduce profitability, add enterprise risk and pour valuable internal resources into a hiring-firing routine that can destabilize and discourage an entire organization long after volume has normalized.

ClosingCorp, San Diego, appointed Christine (“Chris”) Boring as chief product officer, responsible for defining and executing the company’s product vision and strategy and leading product development and implementation efforts.

Are we looking at a downturn? Yes, but in my view, it’s not going to be significant enough to see a huge migration of people out of the mortgage industry. It will, however, require every organization to think hard about how to best use their personnel resources to come out ahead.

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Rana Fleming is Director of Homeowner Assistance and Servicer Reporting with Genworth Mortgage Insurance, Raleigh, N.C. She joined Genworth in 2012.

Construction lending calls for a high degree of perseverance and accuracy to mitigate its inherent risks. The COVID-19 pandemic has made business much more difficult and complex.