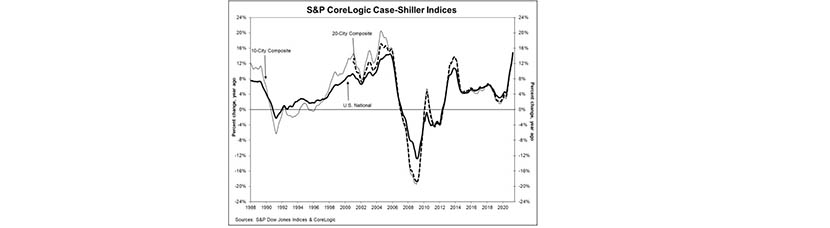

Home Price Reports: Annual Growth Pushes to 15% and Beyond

Two home price reports issued Tuesday said annual price gains in home prices nationwide straddled a nearly unprecedented 15 percent.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index reported a 14.6% annual gain in April, up from 13.3% in March—the 11th consecutive month of increasing prices. The 10-City Composite annual increase came in at 14.4%, up from 12.9% in March. The 20-City Composite posted a 14.9% year-over-year gain, up from 13.4% in March.

In a separate report, the Federal Housing Finance Agency said home prices rose by 15.7% annually.

S&P said Phoenix led all metros in its 20-City Composites with a 22.3% year-over-year price increase, followed by San Diego at 21.6% and Seattle at 20.2% increase. All 20 cities reported higher price increases from a year ago.

Month over month, before seasonal adjustment, the U.S. National Index posted a 2.1% increase in April, while the 10-City and 20-City Composites posted increases of 1.9% and 2.1%, respectively. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.6%, while the 10-City and 20-City Composites posted increases of 1.4% and 1.6%, respectively. All 20 cities reported month over month increases before and after seasonal adjustments.

“Housing prices accelerated their surge in April 2021,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “April’s performance was truly extraordinary. The 14.6% gain in the National Composite is literally the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data. Housing prices in all 20 cities rose; price gains in all 20 cities accelerated; price gains in all 20 cities were in the top quartile of historical performance. In 15 cities, price gains were in top decile. Five cities – Charlotte, Cleveland, Dallas, Denver and Seattle – joined the National Composite in recording their all-time highest 12-month gains.

Lazzara said the strength in the U.S. housing market is being driven in part by reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. “This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years,” he said. “Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing.”

“Pressures on home prices that have built over the last year culminated in the strongest home price growth since the beginning of the data series in 1987,” said Selma Hepp, Deputy Chief Economist with CoreLogic, Irvine, Calif. “And while the acceleration may be met with concerns, mortgage interest rates remain 50% lower than they were in 2005, when home price growth last peaked, keeping the ratio of mortgage payments to monthly household income lower today. It’s probable that continued massive demand will keep pressure on prices, which are likely to remain at double-digit growth rate throughout the remainder of 2021.”

Meanwhile, FHFA reported house prices rose by 1.8 percent in April from March, according to its House Price Index. House prices rose 15.7 percent from April 2020 to April 2021. The previously reported 1.4 percent price change for March was revised upward to a 1.6 percent increase.

For the nine census divisions, seasonally adjusted monthly house price changes from March 2021 to April 2021 ranged from +1.2 percent in the West North Central division to +2.6 percent in the Mountain and Middle Atlantic divisions. The 12-month changes ranged from +13.0 percent in the West North Central to +20.6 percent in the Mountain division.

“This unprecedented price growth persists due to strong demand, bolstered by still-low mortgage rates and too few homes for sale,” said Lynn Fisher, FHFA Deputy Director of the Division of Research and Statistics.