BREAKING NEWS

Share of Loans in Forbearance Falls for 13th Straight Week; Applications Down in MBA Weekly Survey

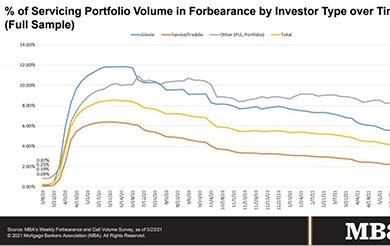

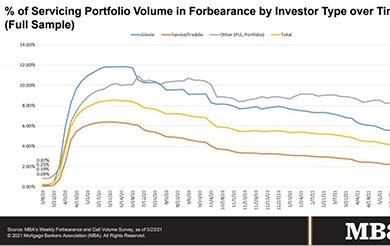

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 1 basis point to 4.18% of servicers’ portfolio volume as of May 23 from 4.19% the prior week--the 13th straight weekly decline. MBA estimates 2.1 million homeowners are in forbearance plans.

Mortgage applications fell again last week, hamstrung by lack of housing inventory and rising prices, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 28.

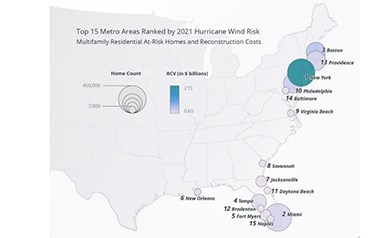

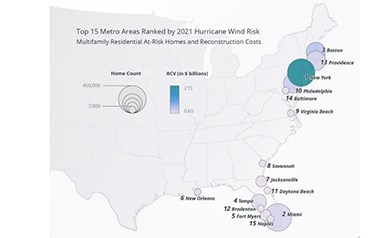

Yesterday (June 1) marked the start of the 2021 hurricane season. The National Oceanic and Atmospheric Administration projected another “above-normal” season, with as many as 20 named storms, 6-10 hurricanes and 3-5 major hurricanes (Category 3 or higher).

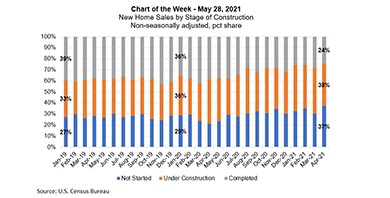

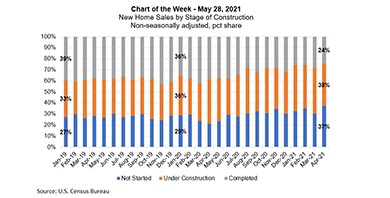

This week’s MBA Chart of the Week shows that there is a declining share of completed homes (24 percent) and a growing share of homes sold that were either still under construction (38 percent) or not started (37 percent).

MISMO®, the real estate finance industry standards organization, announced its president, Seth Appleton, was named a HousingWire 2021 Rising Star.

Berkadia secured financing totaling $94.2 million for industrial and multifamily assets in Arizona and Indiana.

As banking, mortgage and financial services look to remain innovatively different, the quest to “do something” that leverages their people, processes and partners is creating a dystopia during a period of profitability for many leaders unfamiliar with rapid innovations taking place across their markets and offerings.

Zaid Shariff is vice president – head of solution design and product implementation for SLK Global Solutions, a provider of digital platforms and business process management solutions to the banking, mortgage and financial services industries.

The Mortgage Bankers Association nominated Mark Jones, CEO and Co-Founder of Amerifirst Home Mortgage, Kalamazoo, Mich. to serve as its Vice Chairman for the 2022 membership year.

Stacey Berger, Executive Vice President and longtime Co-Head of Midland, Overland Park, Kan., recently announced his retirement effective May 31.

Working from home proved liberating for many people, either because they got more work done or they gained a better work-life balance. At this point, we can’t just put the genie back in the bottle. So, how will the mortgage industry manage the shift back to the office, or will they? Now that our face-to-face meeting-driven, paper-intensive industry has been thrust into the future, does it make sense to return to the past?

When it comes to closing, there are lots of moving parts involved that have traditionally been in person or on physical paper. However, things had to change rapidly. Although a challenge in the beginning, it has also presented a large opportunity and given borrowers and lenders more flexibility in how they complete tasks.