BREAKING NEWS

Loans in Forbearance Fall to 3.91%; RIHA Study Examines Housing Patterns of Older Americans

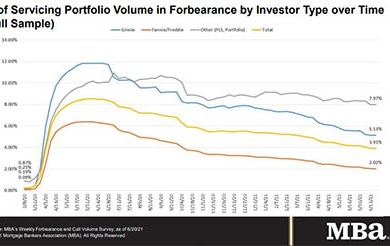

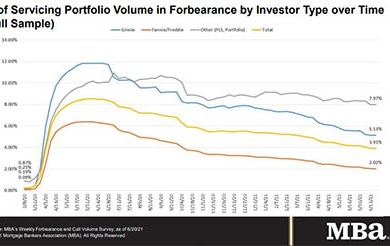

Loans in forbearance fell for the 17th straight week--and for the second straight week, remained below 4 percent--the Mortgage Bankers Association reported Monday.

Older college-educated homeowners are two times more likely to leave the workforce after a job loss than renters, according to a new research report released Tuesday by the Mortgage Bankers Association's Research Institute for Housing America.

The Consumer Financial Protection Bureau on Monday finalized amendments to federal mortgage servicing regulations in response to federal foreclosure moratoria phasing out later this summer.

Ginnie Mae announced creation of a new pool type to support securitization of modified loans with terms up to 40 years.

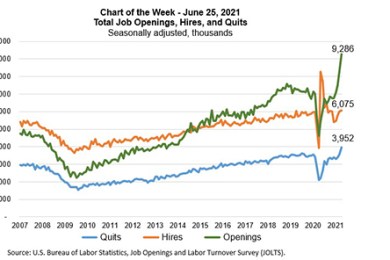

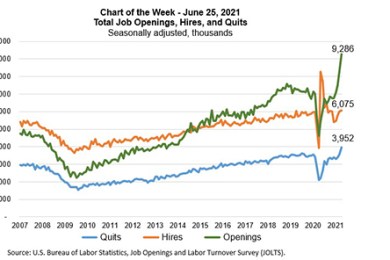

In this week’s MBA Chart of the Week, we examine the monthly data series on job openings, hires and separations produced by the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) program.

HUD on Friday proposed to restore its 2013 Discriminatory Effects Standard—known in the industry as the “Disparate Impact” rule.

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions on Tuesday, Oct. 19.

CBRE, Dallas, arranged $91 million to refinance The Brookwood North San Diego Portfolio.

Future market offerings and IT system delivery are being altered by the exponential expansion of granular, stackable aaS solutions. For industry leaders unaccustomed to using cross-industry building blocks and iterations of offerings, they will find declining profitability against rising industry disintermediation against their core products and services.

Full session and individual speaker proposals are now being accepted for the Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021, taking place Sept. 28–29 via MBA LIVE.

The White House appointed Sandra L. Thompson as Acting Director of the Federal Housing Finance Agency effective immediately.

To extend Remote Online Notarization legislation nationwide, lenders are going to have to get their “back up off the wall” and join MBA efforts to press rulemakers for laws that enable homebuyers and the real estate finance industry to benefit from modern business practices that so many other industries already enjoy.

As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.