Share of Mortgage Loans in Forbearance Decreases to 4.04%

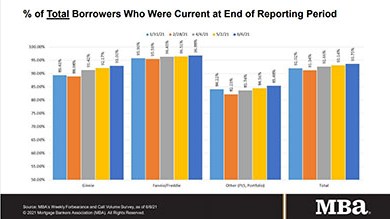

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 12 basis points to 4.04% of servicers’ portfolio volume as of June 6 from 4.16% the prior week--the 15th consecutive week of declines.

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Up 1.1%

Commercial and multifamily mortgage debt outstanding rose by $44.6 billion or 1.1 percent in the first quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report said.

MISMO Launches eMortgage Technology Certification Program

MISMO®, the real estate finance industry's standards organization, launched an eMortgage Technology Certification program to assist lenders in identifying products that comply with industry standards.

ULI: Electrification Key to Decarbonizing Building Sector

The Urban Land Institute, Washington, D.C., said the commercial real estate industry can shift to a decarbonized future by moving to all-electric buildings.

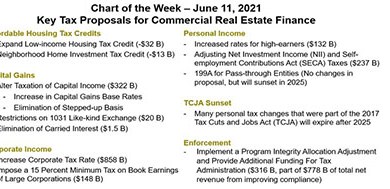

MBA Chart of the Week June 14, 2021: Key Tax Proposals for Commercial Real Estate Finance

The Biden Administration’s proposed Fiscal Year 2022 Budget put down in black and white – and dollars and cents – many suggestions that have been made in more general terms in the Administration’s American Jobs and Family Plan, during the most recent presidential campaigns and in some cases going back decades.