BREAKING NEWS

CMF Delinquencies Fall to Post-Pandemic Low

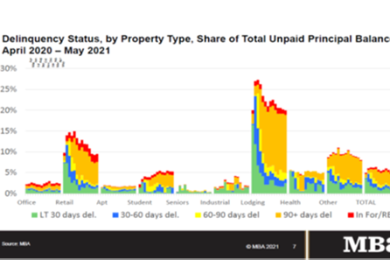

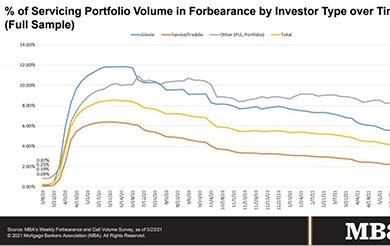

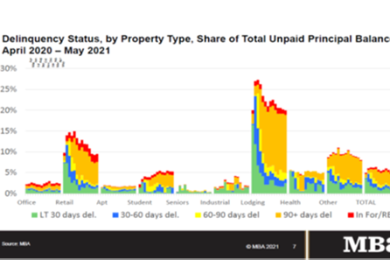

Delinquency rates for mortgages backed by commercial and multifamily properties continue to decline, according to two reports released Thursday by the Mortgage Bankers Association.

The Mortgage Bankers Association and six other industry trade groups filed an amicus brief this week in a court case that could have profound consequences on mortgage debt collection processes.

High-end home purchases U.S. jumped by 26% year over year during the three months ending April 30, compared to a 17.8% gain in purchases of affordable homes and a 14.8% increase in purchases of mid-priced homes, reported Redfin, Seattle.

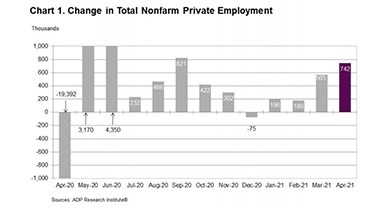

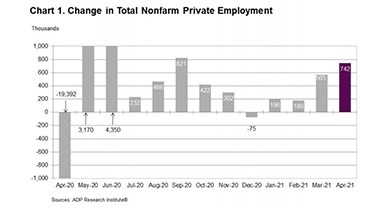

Ahead of this morning’s initial claims report and Friday’s employment report, ADP, Roseland, N.J., said private-sector employment increased by 742,000 jobs from March to April.

Urban multifamily rental demand is improving as pandemic restrictions are lifted and workers return to offices, but a full recovery could take longer than prior recoveries, reported Fitch Ratings, New York.

Mortgage applications fell again last week, hamstrung by lack of housing inventory and rising prices, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 28.

Lument, New York, recently closed $25.7 million in Fannie Mae loans on multifamily assets in Florida and Ohio.

In this article, we will analyze the bottlenecks due to a manual & paper intensive process that lead to loan defects. Based on this understanding, we will investigate the key business risks from such loan defects and how automation can play a role in mitigating these risks.

MISMO®, the real estate finance industry standards organization, announced its president, Seth Appleton, was named a HousingWire 2021 Rising Star.

As banking, mortgage and financial services look to remain innovatively different, the quest to “do something” that leverages their people, processes and partners is creating a dystopia during a period of profitability for many leaders unfamiliar with rapid innovations taking place across their markets and offerings.

Zaid Shariff is vice president – head of solution design and product implementation for SLK Global Solutions, a provider of digital platforms and business process management solutions to the banking, mortgage and financial services industries.

The Mortgage Bankers Association nominated Mark Jones, CEO and Co-Founder of Amerifirst Home Mortgage, Kalamazoo, Mich. to serve as its Vice Chairman for the 2022 membership year.

Working from home proved liberating for many people, either because they got more work done or they gained a better work-life balance. At this point, we can’t just put the genie back in the bottle. So, how will the mortgage industry manage the shift back to the office, or will they? Now that our face-to-face meeting-driven, paper-intensive industry has been thrust into the future, does it make sense to return to the past?