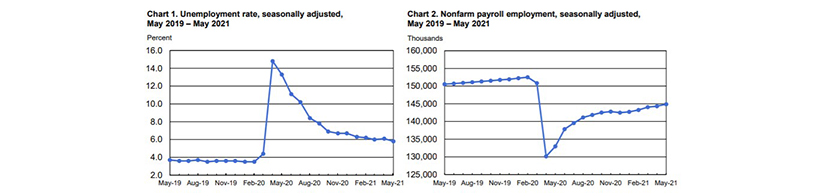

May Employment Up 559,000; Unemployment Rate Drops to 5.8%

(Charts courtesy Bureau of Labor Statistics.)

Total nonfarm payroll employment rose by 559,000 in May, the Bureau of Labor Statistics reported Friday—up substantially from May’s tepid numbers but still below consensus expectations, as hiring slowly recovers from the coronavirus pandemic.

BLS said the unemployment rate declined by 0.3 percentage point to 5.8 percent. The 559,000 May gain comes on the heels of gains of 278,000 jobs in April and 785,000 jobs in March. The number of unemployed persons fell by 496,000 to 9.3 million. These measures are down considerably from their recent highs in April 2020 but remain well above their levels prior to the coronavirus pandemic (3.5 percent and 5.7 million, respectively, in February 2020).

The labor force participation rate was little changed at 61.6 percent in May and has remained within a narrow range of 61.4 percent to 61.7 percent since June 2020. The participation rate is 1.7 percentage points lower than in February 2020. The employment-population ratio, at 58.0 percent, was also little changed in May but is up by 0.6 percentage point since December 2020. However, this measure is 3.1 percentage points below its February 2020 level.

“The increase of 559,000 jobs in May was lower than anticipated, and employment is still 5% below its pre-pandemic level,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “However, there are some signs that suggest better news. April and March employment numbers were slightly revised up – the three-month average change is now running at 541,000 – and in both April and May, the monthly NSA increase was closer to 1 million. The seasonal adjustment is likely significantly complicated by the huge swings in employment over the past year. The NSA changes may be reflecting stronger underlying growth than the headline numbers suggest.”

Fratantoni noted big employment gains included a 186,000 increase in restaurants and bars and a 144,000 increase in education jobs as schools re-opened. “Education employment is still down almost 1.1 million from pre-pandemic levels,” he said. “Manufacturing employment was also up, but construction lost 20,000 jobs. Construction employment is still 225,000 below February 2020. Residential construction employment slightly increased.

Importantly, Fratantoni said, and in another positive sign, long-term unemployment decreased by 431,000 to 3.8 million. “While the debate continues over whether enhanced unemployment benefits are keeping people from looking for work, the improved ability of people who had been looking for work for more than six months to get jobs is encouraging,” he said. He also noted 16.6 percent teleworked due to the pandemic in May, down from 18.3 percent last month, “indicating that more people are returning to the office.”

“The decrease in initial claims for unemployment insurance in recent weeks, the continued robust demand for workers as shown by the high level of job openings, and other data showing increasing economic activity, point to more hiring over the summer,” Fratantoni said. “MBA is sticking with our forecast of a 4.5% unemployment rate by the end of the year.”

“May’s jobs report confirmed that the biggest challenge to the labor market’s recovery right now is labor itself,” said Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “Job openings according to Indeed.com rose further above their pre-pandemic baseline in May and small business hiring plans hit an all-time high, but record demand for workers does not do the economy much good if businesses cannot fill those positions. The share of small businesses reporting at least one job hard to fill jumped to its fourth consecutive record high in May.”

House said despite record demand for workers, the labor market’s recovery has entered a “tricky” phase. “Businesses have reopened faster than workers are able and willing to return to work,” she said. “More than a year on from the start of the pandemic, a declining share of unemployed workers are on temporary layoff, meaning businesses and job-seekers must make new connections. That takes time…the past two months of disappointing job gains illustrate that the jobs recovery is likely to be more drawn out than previously thought.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said 66% of the jobs lost at the start of the pandemic have been recouped. “If monthly gains continue at the May pace, we could return to the pre-COVID employment peak by July 2022,” she said.

But Kushi cautioned construction employment is a “non-substitutable input” necessary to increase the pace of housing starts and increase the housing stock. “In March, there were approximately two unemployed workers per job opening, and more job openings than prior to the pandemic. We need more construction workers,” she said.

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said the May report, while stronger, “is still somewhat anemic” if forecast growth expectations are to be realized. “Overall, we do not believe the pace of job creation shown in today’s report is significant enough to push the Fed to tighten monetary policy any earlier than previously signaled,” he said.

The report said average hourly earnings for all employees on private nonfarm payrolls increased by 15 cents to $30.33 in May, following an increase of 21 cents in April. Average hourly earnings of private-sector production and nonsupervisory employees rose by 14 cents to $25.60 in May, following an increase of 19 cents in April. “The data for the last 2 months suggest that the rising demand for labor associated with the recovery from the pandemic may have put upward pressure on wages,” BLS said.

In May, the average workweek for all employees on private nonfarm payrolls was 34.9 hours for the third month in a row. In manufacturing, the average workweek rose by 0.1 hour to 40.5 hours, and overtime increased by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls declined by 0.1 hour to 34.3 hours.

“In perhaps the clearest sign businesses are desperate for workers, employers are raising wages,” House said. “Wages are moving higher across a number of industries, suggesting the recent moves higher are more than just compositional industry distortions. Rather, wage hikes are the result of employers facing difficulty securing the help they need and competing with higher starting wages in other industries and some large well-known businesses.”

House said wage pressure should persist in the coming months “and could further add to the broader inflationary environment. Although economy-wide profit margins remain fairly elevated from a historical perspective, suggesting firms can absorb some of the higher cost, higher inflation expectations suggest consumers are more apt to accept higher prices. Businesses may therefore leverage the current environment to raise prices and offset higher labor costs. It’s not just more difficult to find workers right now, it’s also more expensive.”