Black Knight: Housing Least Affordable Since 2018

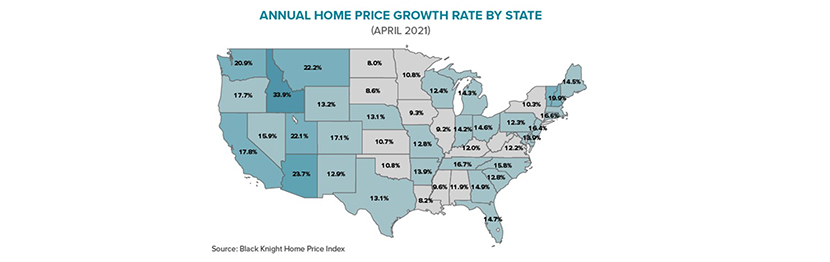

(Graphic courtesy Black Knight, Jacksonville, Fla.)

Black Knight, Jacksonville, Fla., said persistent constraints in for-sale inventory drove home prices up a record-breaking 14.8 percent in April, making housing the least affordable since 2018.

The company’s monthly Home Price Index said April saw the highest annual home price growth rate on record since Black Knight began tracking the metric in the mid-1990s. Single-family prices jumped by 15.6 percent in April; condominium prices rose by 10 percent. Home prices have increased for 17 consecutive months, with the growth rate accelerating sharply in recent months as inventory challenges continue to put upward pressure on prices.

Additionally, the report said active for-sale listings fell by 53% in April from a year ago and by 60% from the 2017-2019 average for April, for a deficit of nearly 750,000 available homes for sale. Black Knight Collateral Analytics found just two months’ worth of single-family inventory nationwide in March, the lowest supply on record and trending downward.

“It now takes 20.5% of the median income to make monthly payments on the median-priced home, which roughly has been the tipping point between accelerating and decelerating home price growth in recent years,” said Ben Graboske, Black Knight Data & Analytics President.

Graboske noted though still more affordable than the 25-year average (23.6%), housing has surpassed its five-year average (20.1%) even with interest rates back below 3% and within ~25 basis points of record lows.

“Of course, such aggressive home price growth has had an impact on affordability levels, even with interest rates back under 3% and within roughly a quarter point of historic lows,” Graboske said. “Entering June, the share of the median income needed to make the monthly payments on the median-priced home had risen to 20.5%. While still more affordable than the 25-year average of 23.6%, housing has surpassed its 5-year average of 20.1% even with interest rates back below 3%. In recent years, 20.5% has roughly been the tipping point at which appreciation begins to decelerate, but given the severity of inventory shortages, home prices have – at least for now – continued to sharply accelerate even in the face of tightening affordability.”