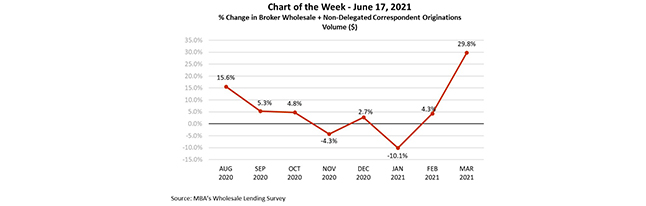

MBA Chart of the Week June 21, 2021: MBA Wholesale Lending Survey

In third quarter 2020, MBA launched a new Wholesale Lending Survey for members to track broker wholesale and non-delegated correspondent volume and related metrics, such as purchase vs. refinance mix, government vs. conventional mix, average days from application to closing and average closings/applications pull-through.

This week’s chart shows the percentage change from the previous month in average broker-wholesale and non-delegated correspondent volume ($) for repeater companies that have reported since inception of the survey. Average monthly volume grew from August 2020 through October 2020, although the rate of growth declined. In two months – November 2020 and January 2021, volume dropped from the previous month. A rebound was apparent in February 2021 and March 2021, when volume surpassed the previous month by 4.3 percent and 29.8 percent, respectively.

Broker Wholesale volume includes processed loan applications that are purchased from mortgage brokers by the lender and closed in the lender’s name with documents drawn by the lender. The lender typically performs underwriting and closing activities, takes responsibility for disclosures, and reports such loans for Home Mortgage Disclosure Act purposes as “making the credit decision.”

The Non-Delegated Correspondent volume includes closed loans that the lender purchases from retail lending shops (correspondents) that do not have delegated underwriting authority. Such loans are underwritten prior to closing by the lender that is purchasing the closed loans. Therefore, while these loans are closed in the correspondent’s name as opposed to the lender’s name, but the lender nonetheless reports such loans for HMDA purposes as “making the credit decision.”

If you are a lender with substantial broker wholesale or non-delegated correspondent originations volume and are interested in participating in next quarter’s survey for Q2 2021, please contact us directly.

Jon Penniman jpenniman@mba.org; Marina Walsh, CMB mwalsh@mba.org.