The State of the Nation’s Housing: Millions Face Risk of Eviction or Foreclosure

Households that weathered the pandemic without financial distress are “snapping up” the limited supply of homes for sale, pushing up prices and excluding less-affluent buyers from homeownership, the Joint Center for Housing Studies at Harvard University reported Wednesday.

At the same time, millions who lost income are behind on housing payments and on the brink of eviction or foreclosure, the Joint Center said in its annual State of the Nation’s Housing report. “A disproportionately large share of at-risk households are those with low incomes and people of color,” the report said.

The report called for additional government support to ensure all U.S. households benefit from the expanding economy. Policymakers must keep people who are at risk from falling further behind, said Chris Herbert, Managing Director of the Joint Center. He noted last year’s “unprecedented” events both exposed and amplified the impacts of unequal access to decent, affordable housing.

“For those households with secure employment and good-quality housing, their homes provided a safe haven from the pandemic,” Herbert said. “But for millions struggling to cover the rent or mortgage, their housing situations have become increasingly insecure and these disparities are likely to persist even as the economy recovers, with many lower-income households slow to regain their financial footing.”

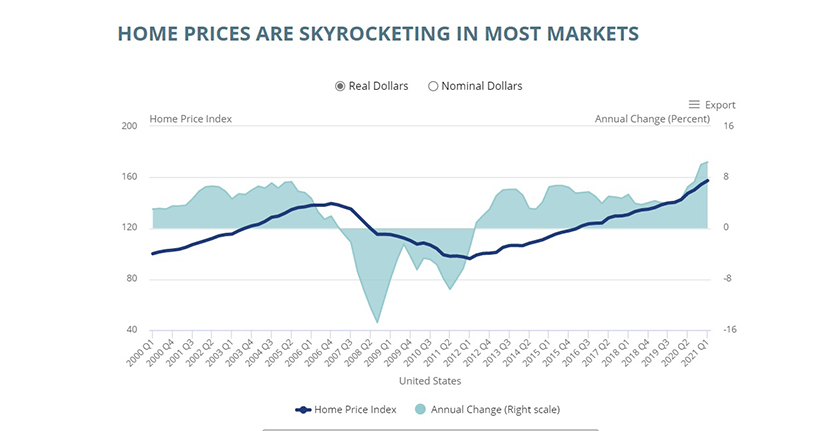

Home sales currently stand at the highest level seen since 2006, the report noted. “Even before the pandemic, household growth in the suburbs and small metros was on the rise,” it said. “The pandemic helped accelerate this growth, particularly among younger households who were ready to own homes and were looking for more space to work remotely.”

Existing home sales rose 6 percent and new single-family home sales jumped 20 percent last year. This “homebuying binge” happened despite historically tight supply, the report said. In late 2020, the number of existing homes for sale dipped below a two-month supply for the first time ever and median time on the market reached a record-low 18 days.

Robust demand and limited supply have raised concerns about a home price bubble, “but conditions today are quite different from the early 2000s, particularly in terms of credit availability,” the report said. “The current climb in prices instead reflects strong demand amid tight supply, aided by record-low interest rates.”

As for rental housing, the report said millions of renter households were still behind on their payments in the first quarter. “Still, rental demand in prime urban areas was already recovering from a jump in vacancy rates earlier in the pandemic,” the report said. “Multifamily housing starts also bounced back from the second-quarter slowdown. But returns to rental property owners took a hit from increases in vacancy rates and operating costs, and mom-and-pop landlords were feeling the pinch of lower rent collections.”

Despite recent growth in new multifamily construction, much of the nation’s rental stock is older and needs maintenance and repairs, the report noted.

The Mortgage Bankers Association’s Research Institute for Housing America provided support for the report.