Consumer Prices Continue to Heat Up

Consumer prices, already fueled by a heated economy continued to accelerate in June to its fastest monthly rate in 13 years, the Labor Department reported Tuesday.

The report said the Consumer Price Index increased by 0.9 percent in June, seasonally annually adjusted, well past consensus expectations of 0.5 percent. The monthly rate was the fastest one-month change since June 2008, when prices rose by 1 percent. On an annual basis, the CPI rose by 5.4 percent, the fastest rate since August 2008.

Consumer prices rose 0.9 percent in June, according to data released Tuesday by the Labor Department, heating up from the previous month.

As with recent months, vehicles drove the increase. The index for used cars and trucks increased by 10.5 percent in June, accounting for more than one-third of the seasonally adjusted all items increase. The food index increased by 0.8 percent in June, a larger increase than the 0.4-percent increase reported for May. The energy index increased by 1.5 percent in June, with the gasoline index rising 2.5 percent over the month.

The index for all items less food and energy rose by 0.9 percent in June after increasing 0.7 percent in May. The report said many of the same indexes continued to increase, including used cars and trucks, new vehicles, airline fares and apparel. The index for medical care and the index for household furnishings and operations were among the few major component indexes which decreased in June.

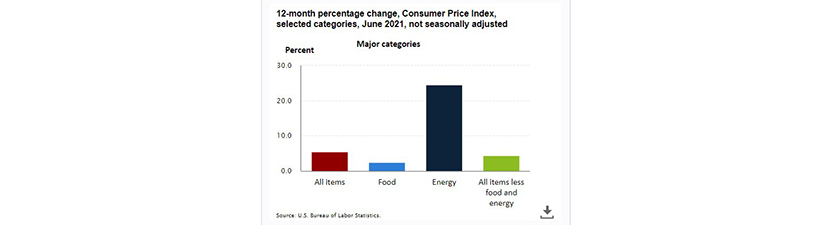

The report noted the all-items index has been trending up every month since January, when the 12-month change was 1.4 percent. The index for all items less food and energy rose 4.5 percent over the last 12-months, the largest 12-month increase since the period ending November 1991. The energy index rose 24.5 percent over the past 12 months, while the food index increased 2.4 percent.

“Price gains continued to be tied to a few relatively small categories, but there is increasing evidence that inflation is broadening out beyond categories at the center of the reopening,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Over the past year, inflation is up 5.4%, a feat made all the more impressive by base effects beginning to get harder after prices first started to rebound last June. Prices have risen at an eye-popping 9.7% annualized pace the past three months as businesses are still struggling to meet surging demand.

House noted over the past year shelter has added 0.9 percentage points to the 5.4% increase in the CPI. “But if we see similar gains in shelter costs as when house prices were last increasing as much as they are today, shelter would add 1.4 percentage points,” she said. “Given the significant year-and-a-half long lag of home prices and the OER component, the upward draft from housing has yet to be realized and will prove more durable. The potential for an even larger boost from shelter comes with rent prices also starting to turn higher.”

In a separate report Tuesday, the National Federation of Independent Businesses reported its monthly Small Business Optimism Index rose by nearly three points to 102.5, its highest level since October. Seven of the NFIB index’s 10 components rose in June, led by a 14-point rise in the proportion of business owners that expect the economy to improve over the next six months. However, Wells Fargo Economics Senior Economist Mark Vitner said despite the jump, small business owners remain wary, with many expecting conditions to worsen over the next six months.

“Small business owners clearly face a challenging environment,” Vitner said. “With their costs rising rapidly, many small businesses are raising prices. The net proportion of small business owners raising prices over the past three months rose seven points to 47%, while the proportion planning to raise prices over the next three months rose one percentage point to 44%. While small businesses are raising prices they are worried about the potential loss of business to larger competitors, which generally have a greater ability to control costs.”

Despite the sharp rise in inflation over the past six months, House said it could be temporary. “We still expect that inflation will not easily revert to the subdued environment of the mid-to-late-2010s,” she said. “The rapid rise in wages the past few months will likely further encourage businesses to hike prices. Businesses inflation expectations remain at their highest rate since the Atlanta Fed started tracking them in 2012, and more small businesses are planning to raise prices than at any time since 1980. Along with consumer inflation expectations having turned around, the disinflationary forces of the past decade fading and the Fed’s greater tolerance of inflation under its new framework, the underlying trend in inflation has moved up in our view. We look for the Consumer Price Index to recede only to about 2.5% by the end of next year, with the core index remaining above the high-water mark of the past cycle.”