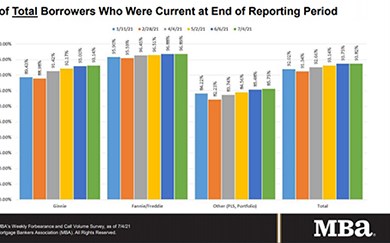

Share of Mortgage Loans in Forbearance Decreases to 3.76%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 3.76% of servicers’ portfolio volume as of July 4 from 3.87% the week before,--the 19th consecutive weekly decline. MBA estimates 1.9 million homeowners are in forbearance plans.

Millennial Homeownership Increases as Credit Loosens

ICE Mortgage Technology, Pleasanton, Calif., said the number of purchase loans closed by millennials in May jumped to 67%; for younger millennials, the percentage was even higher (82%).

Investor Demand Returning to Retail Sector

Consumer retail spending now exceeds pre-COVID levels; investor confidence in retail real estate is also growing, reported JLL, Chicago.

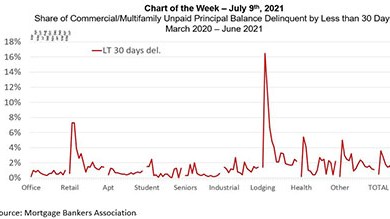

MBA Chart of the Week, July 9, 2021: Commercial/Multifamily Delinquencies

When looking at commercial and multifamily mortgage delinquency rates, we tend to exclude loans that have been delinquent for less than 30 days, as many may be experiencing a temporary “hiccup” that will be quickly remedied before the next payment is due. But examining these rates can provide key insights into commercial and multifamily mortgage performance through the pandemic and into today.

Industry Briefs July 13, 2021

FormFree, Athens, Ga., partnered with ICE Mortgage Technology, part of Intercontinental Exchange Inc., a provider of data, technology and market infrastructure, to make its AccountChek 3n1 asset, income and employment verification service available in the Encompass cloud-based loan origination platform