Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 1

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

The current cycle of banking is coming to an end. By this time in 2022, intra- and cross-industry mergers will dominate growth. Therefore, when it comes down to urgency for conducting a merger and acquisition (M&A) event especially during high valuations and continually changing consumer behaviors, have you identified the who, what, where, why and how of action? Is it about digital technology infusion to stay ahead of competition? Do your M&A efforts include enhancing the customer experience and enriching changing behaviors? Are you acquiring a competitor to limit competition, expand the products and services, or to gain economies of scale? Or is it more focused on current and future financial or operational stability?

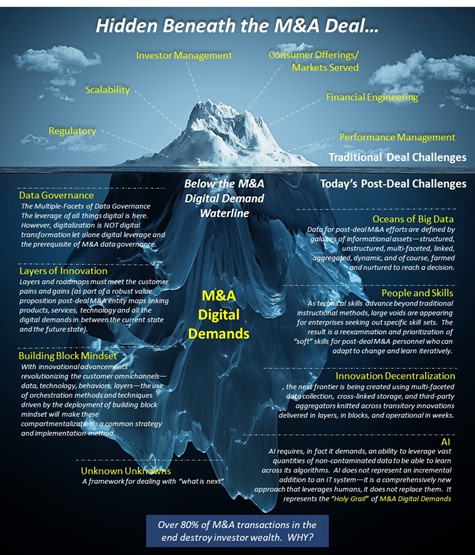

The rationale for the principles of M&A efforts are varied and granular depending upon the maturity of the organizations involved and the measured objectives being sought. Additionally, with the arrival of Industry 4.0[i] and the post-Covid fragmented recovery, enterprises are measuring their performance of the last several years against the progressions sought by investors, and most importantly, by customers. The following diagram quickly showcases the realities facing current and future M&A leadership teams not only in dealing with the post-deal, but moving the assessments, the caveats, and the bridges needed into the pre-deal due diligence because of rapid cycle innovation progressions.

These macro environmental shifts are contributing to a 50% to 60% increase in expected M&A actions by organizational leadership already in 2021. Moreover, while the M&A principles, rationale, and implications transform post-deal efforts, the most important macro impact that will continue to evolve over this next year are which candidates are contained within the merger target list for non-organic growth? As Industry 4.0 changes the business and ESG (environmental, social, and governance) drivers, the playbooks used to determine and conduct banking and financial services (BFS) M&A events have been thrown into turmoil. For mortgage companies, the flattening of the housing demand will arrive in 2021 along with increased costs, competing economic predictions, and a “great” exodus of talent placing pressures on operations and QoS (quality of service) squeezing profits and growth opportunities.

In general, the post-Covid recovery is uneven and unfamiliar resulting in leaders chasing a future vision that is opaque yet transformative. The individual teams conducting due diligence and preparing for post-deal lift-and-shifts are now unprepared for the new Industry 4.0 drivers. As the innovation and operational realities create a steady stream of M&A events enterprises are left with outdated prescriptive post-deal scripts that are about one-and-done cultural solution sets.

Unlike past years, forward looking M&A leaders are recognizing that events driven by industry consolidation have become fraught with risks due to fundamental market shifts creating cascading impacts on existing and proposed business models. These models are also being impacted by cross-sector combinations, private equity actions, and consumers who are revolting against data and privacy abuses. Mortgage lenders will now we required to harvest the investments in digital to offer differentiated customer experiences against declining volumes and rapid-cycle innovations to survive.

M&A on its surface appears to be a financial engineering effort. M&A appears to be prescriptive and focused on control. M&A for BFS is now about asking the right questions, recognizing the dark matter that binds and impacts outcomes, and the need for iterative shifts to innovative business models.

A Transformation Towards Iterative, Innovative Business Models

Putting all business aspects into context, we are fast approaching a world where GDP (gross domestic product) will exceed $100 trillion annually representing a population of over 8 billion individuals within 195 different countries and 180 unique but linked sovereign currencies. As we are too aware, the discrete economies that power products and services are comprised of digital ecosystems interconnected by vast webs of computers, networks, apps, and consumers. Lenders now have the most information ever digitally available about their prospects and customers to determine risk while maximizing portfolios.

Additionally, as people and technologies upend traditional supply chains now comprehensively being remade due to implications of a post-global pandemic, the digital transformations that once took years are now measured in months or weeks. The cycle time of this new informational revolution (i.e., the Fourth, see “Asking the Right Questions” video https://youtu.be/Vhw_VzSXKPM) which began in 2016 is placing extensive pressures on existing and new companies to adopt, adapt, or perish. The utilization of M&A is a means to grow, but also incorporate new innovational demands and offerings that could not be achieved using organic means often due to the hyper acceleration of disruptive technologies (e.g., artificial intelligence).

For investment bankers, CEOs, CFOs and boards, the deal is the driving force—not the post-deal demands or the innovational leverage, especially during a period of easy credit and low rates. As trading revenues decline sharply, the deal flow and forward-looking statements now are creating a frenzy of activity to conduct M&A efforts. However, what is going to be different moving forward when over 80% of the deals fail to achieve investment returns? Are these deals better even in failure because they were cheaper to finance?

M&A deal events now represent the most complex transformations the combined leadership teams could undertake. These integrations are not only complex because of the vast digital assets, computer systems, vast cloud storages, virtualization, and digital layers, but also due to continually changing customer behaviors, regulatory oversight, investor demands, staffing and reskilling, and the lists go on and on.

With the latest presidential executive orders, the once-valued acquire-to-kill M&A event is coming under fire. The “lack of competition” created after decades of M&A expansion is coming into governmental focus creating a potential backlash against deals that are not innovative, customer value defined, or which create competition (per President Biden, “Capitalism without competition isn’t capitalism. It’s exploitation.”).

Noted industries in regulatory focus includes BFS firms and the fact that the top 11 firms now control nearly 50% of all customer assets—up from under 15% just 13 years ago. Coupled with the three-decade trend of 220-260 banks lost each year due to consolidation, and it is obvious that the M&A events moving forward will be highly scrutinized against traditional business model ideals.

The changes inflicted on M&A deals brought on by Industry 4.0 will materially alter due diligence and post-deal systemization especially in the areas of data and the technological building blocks demanded for analysis and decision making. M&A deals within the new business model demands and regulatory oversight will begin with data governance—the new dark matter binding all BFS and mortgage aspects together including technologies, networks, partnerships, and innovational advancements, even though it is frequently misunderstood and only measured by its value on the end results.

Data Governance is the M&A Dark Matter

As frequently noted, our economic and social realities starting in 2017 began to experience a fundamental global shift. The shift is frequently characterized by rapidly accelerating technologies, interconnected digital resources (often across suppliers and competitors), and an orchestration of innovation layers that are assembled, reassembled, and retired often in months—not years.

However, to leverage the digital assets (which is increasingly likely why the M&A event occurred) there must be an overarching integration and sustainability processes and practices to deal with digital demands which are not consistent, lacks integrity, varying levels of aggregation, contains embedded risks, privacy, and security challenges. The first and sometimes largest challenge during the first 90 days after the deal is announced resides with data governance. Who will control? How it is managed, archived, and retired? Where are the sources coming from (its ethics, its bias, its insight, its AI viability, adaptability, and actual usage)? What correction and curation processes are deployed, needed, or simply are not working? How will digital integration success be measured, over what periods of time, and how will they evolve? How do you measure success before the close date (i.e., dark matter concept)?

No, leveraged digital transformation post-deal is not a panacea. No amount of leveraged digital solutions will change market directions nor magically alter the existing products and services. M&A events cannot change realities, but leveraged digital approaches combined with robust data governance can deliver capabilities to detect, anticipate, and secure results as—and what if, should opportunities be presented (leveraging “unknown unknowns”).

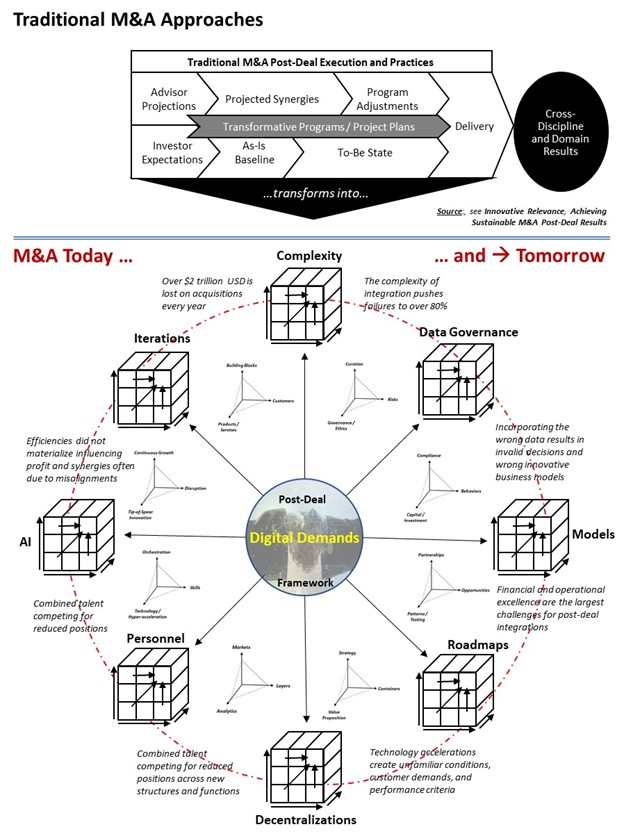

The framework model below touches on a few of the hundreds of impact points taking place in the new M&A environment against the traditional approaches used before Industry 4.0.

To realize the benefits of data governance, enterprise M&A teams must accept the four elements of M&A digital demands—design, development, implement and iterate. Applying these against data governance requires:

- The design of governance principles, rationale and implications are the starting point (and most durable) of every M&A post-deal digital unification and continuous “bleeding edge” transformation. Without this robust, detailed foundation, governance are words, driven by technologies, that provide little sustainable returns.

- Digital curation integrated with the operational governance approach (i.e., principles, rationale, and implications) can be weaved into innovational processes, QoS procedures, and auditability of usage in preparation for advanced tip-of-spear technological implementations and back-office systems.

- The implementation of technologies based on rules and advanced intelligent decisioning offerings only can be sustained after the aforementioned items are diligently addressed, communicated, and incorporated into the roadmaps of M&A digital transformations. The trap many M&A teams suffer is that they start with implementations—not the governance and business drivers demanded for sustainable, repeatable results.

- In an ongoing challenge to deal with internal and external volatility, uncertainty, complexity, and ambiguity enterprises will need to conduct their digital governance in bursts of progressive actions rather than large, monolithic (non-iterative) programs.

And, as noted in the above diagram, data governance is just one of eight new dimensions impacting M&A events in an era of Industry 4.0. The strategic imperatives have changed and their impacts on post-deal events and consequences cannot be discounted or ignored (in the hope of returning the old methods and techniques).

A Strategic Imperative of Post-Deal Requirements

Indeed, the world of M&A post-deal integration is fraught with challenges—beginning with data demands. To put these M&A digital demands into focus, we should note the growth of world economies, changing skills sets, and regulatory realities. What we have covered does not represent academic ideals that are too visionary, too esoteric, too far-fetched, or too variable. It represents the emerging realities of today’s operating complexities that are unfamiliar as Industry 4.0 expands during its fifth year of a likely 25 year economic and technology cycle.

These macro conditions impact not just the ability to digitally integrate companies, but face vast risks from fluid consumer privacy issues, cybersecurity protections, cascading errors and assessments created by bots and automation, and simmering biases becoming codified in algorithms that are opaque and iterative. The world of the future is all about digital, and the demands to not just meet the letter of the M&A. However, the spirit of the M&A will take precedent regardless of what the press releases state.

My colleagues sometimes refer to M&A post-deal digital integrations as a “death by a thousand cuts.” For no matter how eager investors are for the entities to be combined, their expectations never seem to match the reality of the ensuing chaos that often envelops the post-deal events.

Ultimately, synergies are missed, careers are destroyed, and customer and investor values are lost. Was it the financial engineering that was wrong? Did the due diligence efforts fail in their goal for a “deep dive?” Did the post-deal leadership teams apply proven methods to new M&A digital realities only to discover they lacked relevancy?

The deal within digital economies is still compelling. However, the capability of existing M&A teams is insufficient to create sustainable and repeatable digital solution sets in an era where innovative advancements are measured in weeks and months. Digital demands must not only be designed and implemented, but also developed iteratively and using compartmentalization.

When it comes to the M&A post-deal efforts, there is a failure to recognize that frameworks are more powerful than prescriptions, that iterations and pivoting are more important than strategic plans, that digital demands are not lift-and-shifts, but layers, building blocks and data governance built on the new business foundations of “dark matter” data oceans.

In the end, delivery of M&A Digital Demands is not simply using tradition—it is something else entirely. In the end, if we believe our M&A traditions are unaffected by new digital demands, it comes down to “are we asking the right questions?” In the end, how will you change your M&A post-deal integrations to meet the innovations and emergent drivers of Industry 4.0? (You can find a comprehensive video on Industry 4.0 and its impact on our decision making at https://youtu.be/Vhw_VzSXKPM.)

[i] Industry 4.0 or the Fourth Industrial Revolution is characterized by intelligent innovations, rising data volumes and usage, a loss of privacy and security, innovation singularity, and cycle times of products and services that are measured in weeks and months—not years. It is projected to last until 2050, while having profound impacts on cultural divisions, economic progressions and educational demands.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)