Consumer Confidence Up, But COVID Fears Linger

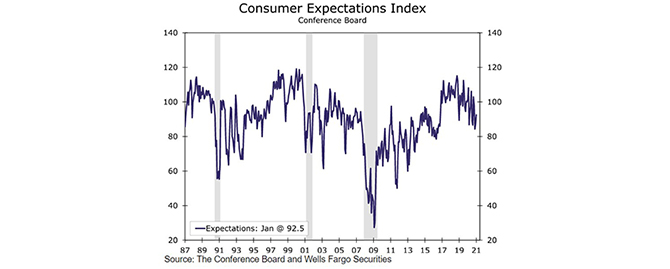

(Chart courtesy The Conference Board.)

The Conference Board, New York, said its Consumer Confidence Index improved moderately in January, the first gain in four months.

The Index now stands at 89.3, up from 87.1 in December. However, the Present Situation Index – based on consumers’ assessment of current business and labor market conditions – decreased from 87.2 to 84.4. The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – increased from 87.0 in December to 92.5 this month.

“Consumers’ appraisal of present-day conditions weakened further in January, with COVID-19 still the major suppressor,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “Consumers’ expectations for the economy and jobs, however, advanced further, suggesting that consumers foresee conditions improving in the not-too-distant future. In addition, the percent of consumers who said they intend to purchase a home in the next six months improved, suggesting that the pace of home sales should remain robust in early 2021.”

“Consumer confidence at 89.3 in January is a bit better than the 89.0 that had been expected and an incremental improvement from the downwardly revised reading of 87.1 in December,” said Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “Note however, that this is just 3.6 points above the post-pandemic low of 85.7 reached in April at the height of the lockdowns. In short, this is not as bad as expected, but still not particularly good. As the rollout of the vaccine progresses, we anticipate consumers will gradually regain some of the lost confidence, although a full return to pre-pandemic swagger will likely require a more robust recovery in employment than we currently have in our forecast.”

The report said consumers’ appraisal of current conditions weakened further in January. The percentage of consumers claiming business conditions are “good” increased from 15.4 percent to 15.8 percent, but those claiming business conditions are “bad” also increased, from 39.7 percent to 42.8 percent. Consumers’ assessment of the labor market was also less favorable. The percentage of consumers saying jobs are “plentiful” declined from 21.0 percent to 20.6 percent, while those claiming jobs are “hard to get” rose from 22.9 percent to 23.8 percent.

Consumers, however, have continued to grow more optimistic about the short-term outlook. The percentage of consumers expecting business conditions will improve over the next six months increased from 29.5 percent to 33.7 percent, while those expecting business conditions will worsen decreased from 22.0 percent to 18.1 percent. Consumers’ outlook regarding the job market also improved. The proportion expecting more jobs in the months ahead increased from 28.0 percent to 31.3 percent, while those anticipating fewer jobs decreased from 22.2 percent to 21.4 percent. Regarding their short-term income prospects, the percentage of consumers expecting an increase declined from 15.7 percent to 14.4 percent, however the proportion expecting a decrease also declined from 14.6 percent to 14.2 percent.

“There is a growing sense among consumers that although we are going through a difficult winter, the tide is turning,” Quinlan said.