ANNOUNCEMENT

The weekly MBA Forbearance & Call Center Report, which usually comes out Mondays at 4:00 p.m. ET, will come out today (Tuesday) at 4:00 p.m. ET because of the holiday break.

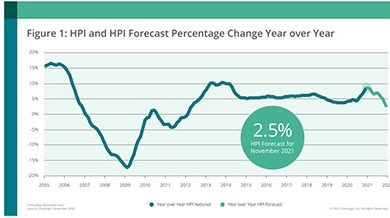

CoreLogic, Irvine, Calif., said its November U.S. Home Price Index saw its largest annual appreciation since March 2014. The report said nationally, home prices increased by 8.2% in November from a year ago. On a month-over-month basis, home prices increased by 1.1% from October.

Cap rates in the single-tenant net lease retail and industrial sectors fell once again in the fourth quarter to record lows, reported Boulder Group, Wilmette, Ill.

![]()

Simon Property Group, Indianapolis, completed its acquisition of an 80 percent ownership interest in The Taubman Realty Group Limited Partnership, Bloomfield Hills, Mich.

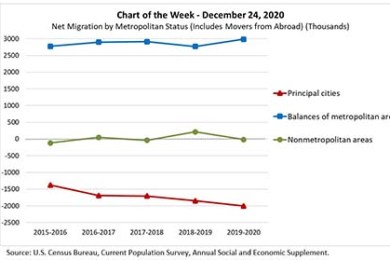

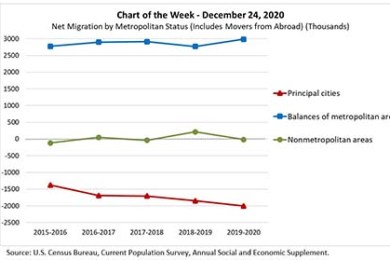

This week’s MBA Chart of the Week shows net migration by metropolitan status over the past five years. The green line shows that the net movement into nonmetropolitan areas has hovered around zero, growing by an average of 19,000 migrants (nationally). On the other hand, metropolitan areas absorbed more than 5.7 million migrants over this period.

The Mortgage Bankers Association introduces a new three-part virtual series, Voices: Courageous Conversations with Women of Color, beginning Tuesday, Jan. 12.

The Mortgage Bankers Association is accepting nominations for the MBA NewsLink 2020 Tech All-Star Awards. Nominations will be accepted through Friday, Jan. 29.

CBC Mortgage Agency, Cedar City, Utah, promoted Miki Adams to president. Adams takes over from Richard Ferguson, who will work on developing new affordable housing initiatives.

As the commercial real estate finance market experienced fits and starts last year, no capital source provided more transparency into commercial real estate than CMBS with its monthly investor reporting and credit rating agency coverage creating a window into market performance and challenges for certain retail and hospitality assets.

As mortgage technology continues to evolve, it needs to look inward, toward manufacturing loan assets to truly streamline the mortgage lending process as we know it.

MBA NewsLink interviewed GME Enterprises President and CEO Gwen Muse-Evans about mortgage servicing during a pandemic.

Leveraging the right data analytics can provide today’s mortgage companies with many competitive advantages and allow them to better support their LOs - letting them focus on what they do best and maximizing both customer satisfaction and revenue.

Arbor Realty Trust, Uniondale, N.Y., financed $111.7 million in Fannie Mae loans for properties in six states.