MBA Advocacy Update, Jan. 25, 2021

On Wednesday, HUD issued a waiver allowing FHA to insure loans to borrowers with residency under the DACA program. And on Tuesday, FHFA issued an RFI on risks posed by climate change and natural disasters to Fannie Mae, Freddie Mac, the Federal Home Loan Banks and the broader housing finance system.

Existing Home Sales Finish 2020 at Highest Levels Since 2006

Existing home sales finished 2020 with the strongest performance in 14 years, the National Association of Realtors reported on Friday.

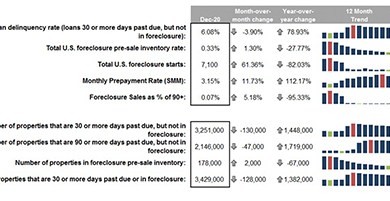

Black Knight First Look: 2020 Ends with Higher Delinquencies, Lower Foreclosures

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

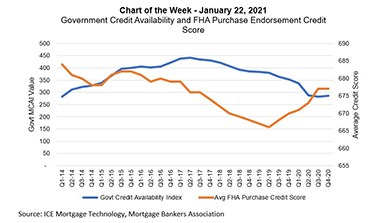

MBA Chart of the Week: Government Credit Availability & FHA Purchase Endorsement Credit Score

Lenders tightened mortgage credit in the first half of 2020, as the onset of the COVID-19 pandemic caused the economy to suffer its sharpest single-quarter contraction in history. Mortgage credit availability, as measured by our series of indexes, has recovered slightly in recent months. However, availability is still close to its tightest levels since 2014.

Industrial, Apartment Price Growth Bolsters CRE Asset Prices

U.S. commercial property price growth accelerated in late 2020, driven by “robust” apartment and industrial sector price increases, said Real Capital Analytics, New York.