Job Losses Mark December Employment Report

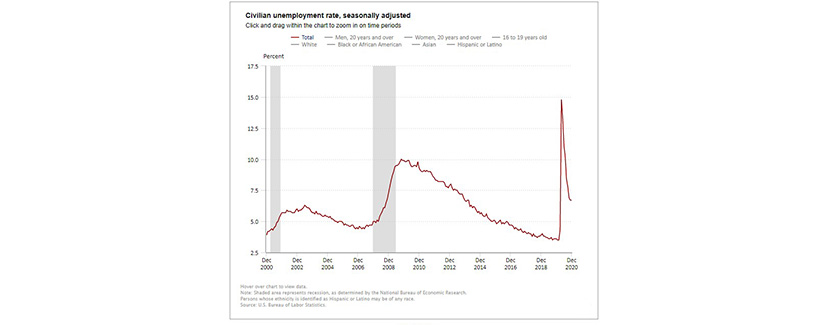

The U.S. economy shed 140,000 jobs in December, the Bureau of Labor Statistics reported Friday, although the unemployment rate held steady at 6.7 percent.

The December losses—the first job losses reported since last April—upended consensus forecasts that predicted a gain of 50,000 jobs. Gains in construction employment—with housing continuing to be an economic bright spot—were more than offset by losses in the hospitality and service industries.

BLS said the decline in payroll employment reflects the recent increase in coronavirus cases and efforts to contain the pandemic. In December, job losses in leisure and hospitality and in private education were partially offset by gains in professional and business services, retail trade and construction. Despite this, both the unemployment rate, at 6.7 percent, and the number of unemployed persons, at 10.7 million, were unchanged.

The change in total nonfarm payroll employment for October was revised up by 44,000, from +610,000 to +654,000, and the change for November was revised up by 91,000, from +245,000 to +336,000. With these revisions, employment in October and November combined was 135,000 more than previously reported. The labor force participation rate and the employment-population ratio were both unchanged over the month, at 61.5 percent and 57.4 percent, respectively. These measures are up from their recent April lows but are lower than in February by 1.8 percentage points and 3.7 percentage points, respectively.

“The intensifying pandemic impacted the labor market to close 2020,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Faster layoffs led to a loss of 140,000 jobs in December, but the unemployment rate was unchanged. Total employment remains 6.5 percent below the level in February 2020, with the greatest job losses still in the leisure and hospitality sector – down 23 percent. There were 372,000 job losses at restaurants and bars last month, which is obviously a direct impact of the restrictions due to the pandemic.”

Fratantoni noted the increase in those on temporary layoff reflects the impact of renewed lockdowns and other restrictions, while the decrease in those in the long-term unemployed category is positive, as it may reflect that these workers have been successful in finding work. “While this is good news, some workers’ new job may well be at a lower income than their prior position,” he said. “It is notable that there were gains of 51,000 in construction employment in December. The lack of inventory is the biggest constraint to further growth in home sales this year. More workers in the sector should support the faster pace of housing construction the market needs.”

Fratantoni said MBA not only expects that job growth will pick up in the second half of the year, “we anticipate a strong rebound, as pent-up demand for a range of goods and services will require rapid hiring as the pace of vaccine deployment accelerates. Despite the negative news from this report, we still expect 2021 to be a record year of purchase mortgage originations volume.”

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the impact of the pandemic has been uneven across the U.S. economy. “The uneven impact of the virus on high-contact services and jobs where it is easier to socially distance was on full display in December,” she said. “Yet if there is a bit of good news in today’s report, it is that layoffs were skewed toward temporary separations, which keep workers more closely connected to employers and should facilitate faster re-hiring when activity strengthens.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said more concerning than the headline number are the millions of people who are now considered long-term unemployed; the report noted the number of long-term unemployed (those jobless for 27 weeks or more) is relatively unchanged relative to last month, but accounts for 37 percent of total unemployed in December.

“Long-term unemployment last ballooned during the Great Recession, hovering around 40% of the overall jobless population from late 2009 into 2013, the highest in the series’ 73-year history,” Kushi said. “The potential implication? Permanent economic scarring and a prolonged recovery.”

Kushi said housing remains a bright spot entering 2021. “Residential construction jobs increased nearly 1.1 percent in December relative to November and are now 0.8 percent above their pre-pandemic levels in February,” she said. “Increasing the number of construction workers is critically important to alleviating the labor shortage challenge and the gap between household formation and home building. More hammers, more homes. This month’s jobs report was great news for a housing market in desperate need of more supply. However, we’ll be keeping an eye on the ongoing supply-demand imbalance resulting from years of under building.”

The report said average hourly earnings for all employees on private nonfarm payrolls increased by 23 cents to $29.81. Average hourly earnings of private-sector production and nonsupervisory employees increased by 20 cents to $25.09. These increases largely reflect the disproportionate number of lower-paid workers in leisure and hospitality who went off payrolls, which put upward pressure on the average hourly earnings estimates.

BLS said the average workweek for all employees on private nonfarm payrolls declined by 0.1 hour to 34.7 hours in December. In manufacturing, the workweek was unchanged at 40.2 hours, and overtime increased by 0.1 hour to 3.3 hours. The average workweek

for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 34.2 hours.