Jim Cameron: Balance is Key for Managing Capacity and Cycle Times

Jim Cameron is a senior partner with STRATMOR Group, Greenwood Village, Colo., a leading mortgage advisory firm. He has 30 years of leadership experience in the mortgage industry. At STRATMOR Jim specializes in benchmarking and performance measurement, strategic planning and merger and acquisition services. Jim was instrumental in the development of the industry-standard benchmarking program known as the MBA and STRATMOR Peer Group Roundtables (“PGR”) Program, and he continues to lead the STRATMOR team that works with the MBA. He regularly lends his moderator skills to MBA and other organizations on such topics as accounting and financial management, mergers and acquisitions strategies and industry trends. He can be reached at Jim.cameron@Stratmorgroup.com.

When I look back on 2020, I think about what a peculiar year it’s been. We have a pandemic and world-wide recession, yet a mortgage market that is expected to set records for originations and profitability. But along with the increase in volume, lenders are struggling to move loans through their pipelines in a timely way to meet borrower demand.

This dynamic has heightened the challenge lenders have always had—balancing costs with productivity. And if anything, 2020 has demonstrated lenders have a lot of work to do.

Dealing with Pipeline Pressure

Indeed, closing times have increased across the industry. Ellie Mae’s Origination Insights Report from October showed the time to close all loans increased from 51 days in September to 54 days in October, which was up from 44 days in October 2019. The 54 days to close in October 2020 represents the slowest turnaround time since September 2012.

As might be expected, the time to close refinance loans, which represented 60 percent of the volume in October, was higher than purchases, with refinance loans taking an average of 57 days to close. Purchase loans took an average of 48 days in October, Ellie Mae reported.

The situation has gotten so extreme that some mortgage lenders are raising rates and margins in order to slow down application volumes, simply because they cannot fulfill the loans with the staffing and infrastructure they currently have in place. Labor costs are skyrocketing, too, as lenders bid for operations staff such as underwriters and processors, and extra margin is needed to cover those costs.

Mortgage firms are offering signing bonuses to lure underwriters and processors away from competitors and are even giving retention bonuses to current employees to keep them from leaving. We’ve also heard of mortgage companies giving attractive bonuses to employees who bring on new staff.

The Cycle Time/Cost Dilemma

STRATMOR’s research has shown that cycle times are a critical element of customer satisfaction. Borrowers today realize that it’s important to find a lender that can provide some sort of assurance on how long it will take to close their loan, rather than to simply shop for the lowest rate.

However, there is a cost associated with shortening the length of time between loan application and closing. To quantify the relationship between cycle times and cost, STRATMOR Group analyzed data from the MBA and STRATMOR Peer Group Roundtables (PGR) program for 2019. For the mid-sized independent lender peer group, we created two subsets of lenders — one with the highest average cycle times and one with the lowest cycle times.

We found that lenders in the top 25 percent for cycle times averaged 33 days from application to closing, while lenders in the bottom 25 percent averaged 44 days. The top quartile lenders with the fastest cycle times had higher costs, spending $430 more per loan than bottom quartile lenders with the slowest cycle times, illustrating the tradeoff between cycle times and cost.

Options for Addressing Capacity

What steps can lenders take to manage capacity and reduce closing times? For starters, they can make processing more efficient. An August STRATMOR operations workshop found that processing is currently the number one bottleneck in operations.

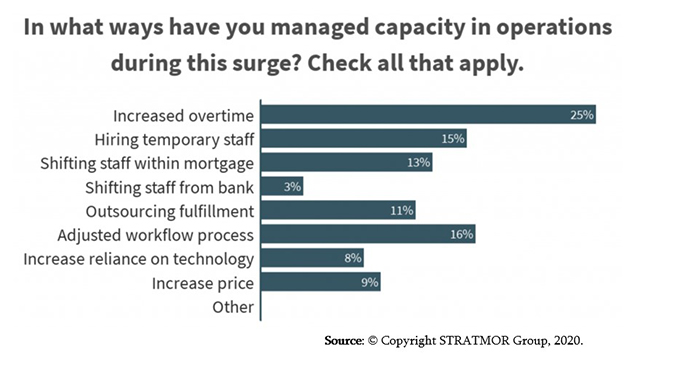

Some of the more popular solutions lenders are using include paying overtime, shifting staff from other parts of the company and adjusting the workflow process, according to a recent STRATMOR poll. The chart below shows eight methods lenders have been using to manage capacity:

However, paying overtime, the most popular way lenders are using to manage capacity, is causing concern among lenders about the impact that stress and long hours are having on their staff. Operations executives are trying to find a balance between adding enough staff to temper the strain and preserve at least a minimal amount of work-life balance, but not adding so many new employees that it will result in layoffs when this boom cycle ends.

At the August operations workshop, some of the executives shared their strategies on training existing staff. Others discussed mentoring programs and bringing in recent college graduates to teach them processing from the ground up. Though training inexperienced staff may be challenging, it’s a strategy that STRAMOR encourages lenders to consider, especially in the current high-volume environment.

Invest in New Hires or Technology?

This brings me to the dilemma lenders are facing today: Should they add more staff to improve cycle times, thus increasing the cost to produce? Or would it be better to invest in technology to reduce cycle times, even though it will increase costs in the short run?

That’s one of the biggest challenges for lenders, especially when they are too busy or lack the capital required to make the necessary changes and investments in technology. One mortgage executive recently said to me, “It is hard to think long-term when your house is burning down!” Others have asked: “How can we fix the train when it is moving 100 miles per hour?”

Many of the lenders in STRATMOR’s recent operations workshop acknowledged that it is important to keep up with and invest in ongoing improvements in technology. Yet some executives feel that for now, they don’t have the luxury of continuing full speed ahead with technology projects, which take up vital resources and time.

We advise lenders to work to find the right balance between making things work in the present and making wise decisions and investments for the future. For example, eClosings and the use of process automation tools such as bots, artificial intelligence (AI) or machine learning require an investment of time and resources that take away from short-term profits, but the investments have obvious long-term benefits.

As 2020 has demonstrated, things can change very quickly, and lenders will face even more challenges in the coming year. But in our view, the lenders that are able to balance volume and profits with investing in resources and technology for the future will undoubtedly come out ahead.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)