Veros: Home Prices Set to Increase Nearly 6% in 2021 as Nation Emerges From Pandemic

Veros Real Estate Solutions, Santa Ana, Calif., released its Q4-2020 VeroFORECAST data, projecting home price appreciation will increase significantly during the next 12 months in the 100 most-populated markets.

The overall average forecast is 5.9% by Q4 2021, an additional increase of 0.9 percentage points compared to 5% just a quarter ago. This level of change from one quarter to the next is heavily driven by the ultra-low interest rates and population migration trends.

“Data remains strong into 2021 with almost no major metro area showing notable home price depreciation over the next 12 months,” said Darius Bozorgi, CEO of Veros Real Estate Solutions. “The projected increase is nearly one percentage point higher than it was for the previous quarter, which is being driven by continued low interest rates and buyer demand.”

“Ultra-low interest rates and other government stimulus has allowed the housing market to boom, despite the Coronavirus pandemic of 2020,” said Eric Fox, Veros Vice President of Statistical and Economic Modeling. “Home prices across the nation have returned to their pre-pandemic level and will move upward steadily in 2021 as job creation is restored and vaccinations take hold around the country.”

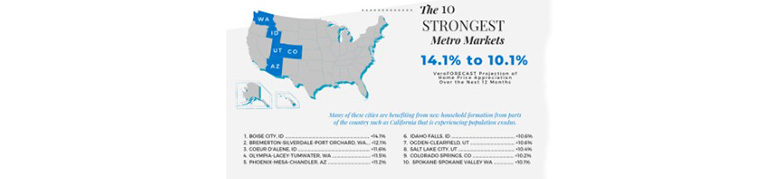

The forecast said western statees are leading the national price increases. Cities in Idaho, Washington, Arizona, Utah, and Colorado comprise the entirety of the Top 10 metro areas. Appreciation is forecast to continue strengthening with Boise up 14.1% by Q4 2021. Many of these cities are benefiting from new household formation from parts of the country such as California that is experiencing population exodus.

The list of least-performing markets is led by three cities in Texas. Two of these markets are heavily dependent on the oil and gas industry, which was hit hard by reduced market demand and soft prices. While all of these under-performing markets are projected to yield some increase in 2021, the rate is much lower than the rest of the top 100 markets.

The New York City metro area, which encompasses most of New Jersey and parts of Connecticut, is forecast to appreciate at just above 3%, making it just out of the 10 Least-Performing markets. However, many New York City boroughs are forecast to depreciate over the next 12 months with -4% depreciation in Manhattan.