BREAKING NEWS

MBA Forbearance & Call Volume Survey; MBA Mortgage Credit Availability Index; MBA Commercial/Multifamily Quarterly Originations Survey

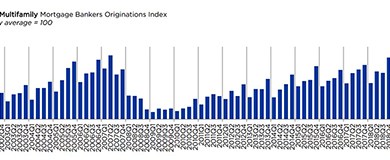

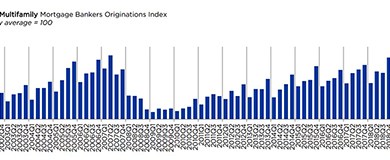

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

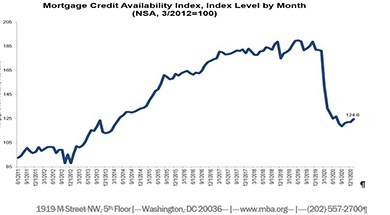

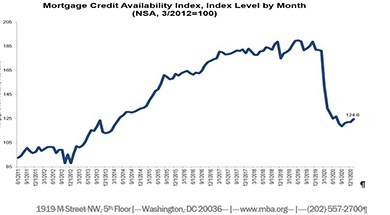

Mortgage credit availability increased in January, the Mortgage Bankers Association reported this morning.

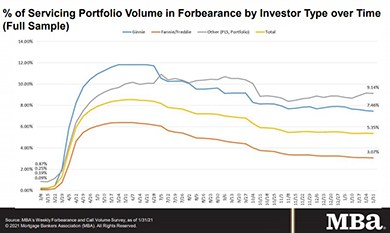

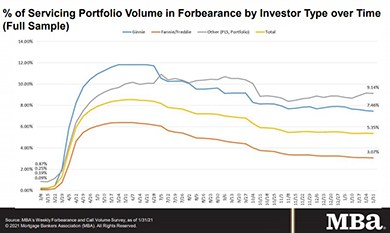

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.35% of servicers’ portfolio volume as of Jan. 31 compared to 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

![]()

The Mortgage Bankers Association and nearly 300 other industry trade groups and community organizations urged Congress to include direct assistance to homeowners with COVID-19 hardships in any upcoming economic stimulus package.

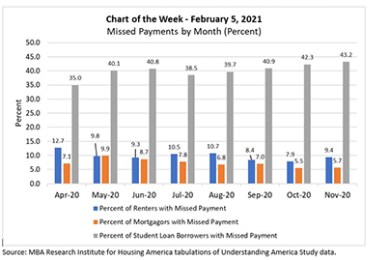

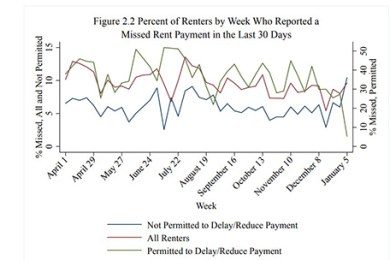

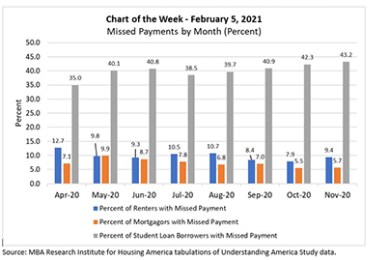

This week’s MBA Chart of the Week chart provides a preview of newly updated pandemic-related household financial insights that MBA’s Research Institute for Housing America released this morning, Feb. 8.

One year ago, almost no one could have predicted what 2020 would bring. Everyone in the real estate world had to adjust their expectations.

MISMO, the industry standards organization, has instituted a $0.75 per loan Innovation Investment Fee.

The Mortgage Bankers Association announced Steven Plaisance as chairman of the Mortgage Action Alliance and Jeffrey "Jeff" C. Taylor as Chairman of the MBA Political Action Committee (MORPAC).

Berkadia announced it secured $75.1 million in combined financing for three garden-style multifamily properties in Michigan: Dearborn View Apartments, Bedford Square Apartments and Delta Square Apartments.

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

We take a closer look at decision intelligence and why mortgage executives are prioritizing this new concept in their business operations.

Historically a cyclical business, mortgage lending has experienced substantial increases in volume, forcing lenders to throttle up their efforts, but those without an intelligent Loan Manufacturing (iLM) plan have been left with more challenges.

On Tuesday, MBA, along with several trade organizations, submitted a letter to the Office of the Comptroller of the Currency responding to its approach to the Community Reinvestment Act. On Thursday, the House Financial Services Committee held a hearing on the next COVID-19 relief legislation. And the Senate Banking Committee approved Rep. Marcia Fudge’s nomination to be HUD secretary.