Mark P. Dangelo: Establishing a Foundation for AI Growth and Profitability

Mark P. Dangelo is Chief Innovation Consultant with BlackFin Group, Laguna Hills, Calif., responsible for leading and managing innovation-led business transformation and technology projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of four innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

Artificial intelligence (#AI) discussions and planning within financial services and banking organizations (#FSBOs) meetings has become a commonplace conversation. Interject the touchpoint topics of machine intelligence (#MI), deep learning (#DL), big data (#BD) and of course, robotic process automation (#RPA), and watch everyone nod their heads approvingly as if articulating the topics signify implementation and customer success.

However, the next 18 months will prove that less than 15% of these magnificent AI projects will meet the minimum corporate ROI projections—the rest will be chalked up as “learning” initiatives. For FSBO leadership, AI represents a quantum shift of definition, development and implementation—and without a robust digital transformation roadmap, the probability of leveraging investment is vastly reduced.

In the end, regardless of the returns or the drawbacks, it seems when it comes to AI we claim success for the organization. However, the criteria and timeframes used to assess progress are based on foundations of innovation cycles that lack efficacy when it comes to the necessary iterative, building blocks of AI. Why? Aren’t we (and our customers) living in the Age of Digital? Aren’t these panaceas of information technology, founded over 30 years ago on rudimentary neural networks, commonplace when it comes to innovative FSBO offerings? Aren’t AI solutions just an extension of IT systems and personnel capability? Our vendors have proposed that AI is not as difficult, even if we do not have internally robust digital strategies and data governance, right?

The reality is that AI offers some incredibly unique challenges that must be proactively defined, analyzed, planned, and implemented especially within FSBO’s and siloed business units such as lending. For all but the largest FSBO’s, the definition and deployment of AI and its interconnected disciplines and dependencies, the burden of execution is proposed as a value proposition around already installed software—not as a comprehensive transformative force. However, as the progression of AI solutions advance at a four times greater rate than the heralded Moore’s Law of computing power, the skills needed and the proactive design architecture demanded are not about incremental application delivery or a one-off vendor product.

AI represents an innovative disruption—not an incremental advancement such as replacing an LOS, adding a POS, or streamlining servicing. AI is becoming a disruption that requires a proactive blending of humans with technology to arrive at a value proposition underpinned by stable operational principles. For even in the fast-paced world of lending, where volumes have masked the need for digital transformations and customer insights, deployment of AI is an accident waiting to happen without the careful strategies, roadmaps and architectures necessary to iterate solution sets that arrive at hyper-accelerated rates of continuous expansion and implementation.

Therefore, what are the suggestions, answers and paths forward? There are three experiential pillars necessary for FSBOs to sustainably leverage AI for the greatest organizational and customer experiences.

First, AI even after three decades of advancement, represents a disruptive innovation—an innovation tip-of-the-spear (#ITOS) set of evolving solutions. These disruptive innovations represent the future of many FSBO application engines, yet they are not panacea’s that can be traditionally implemented by a vendor and forgotten. The building blocks of AI represents advanced machine capabilities, making “human” decisions using vast amounts of data (e.g., internal, external structured, unstructured), performing 24 by 7, and at speeds and volumes that potentially could displace vast swaths of unskilled workers. Yet, AI also demands learning curves, unbiased training data induced to create a “thinking” machine, algorithmic webs of branches and decisioning, ethical conduct (assuming the data and “trainers” are ethical), and corrective capabilities (as AI will make mistakes). ITOS for AI is what is happening now. There is a lot of promise, but a lot of complexity and uncertainty yet to be mitigated.

Secondly, the reality around AI is that in the last 24 months it has advanced more than the prior 30 years. The rise and leveraging of the FSBO efforts on digitization coupled with non-FSBO industries inducing the consumer to accept the benefits of mobility, apps, privacy, security, and dozens of other trends has created an acceptance and innovation singularity of AI. The rise of digital leverage (e.g., #dLeverage)—the ability and capability of expanding digital strategies into actionable process and decision efficient solutions—for forward looking ITOS efforts has created evolving roadmaps of insight and profitability for FSBOs who are disciplined and rigorous in their AI approaches. However, proactive digital leverage is a robust discipline and mindset that has found efficacy only in about 5% of the FSBOs—due to budgets, current market forces, and internal skill sets. dLeverage represents a forthcoming core competency for many FSBO’s, but it also will likely hasten the demise of more FDIC institutions who fail to recognize the quantum shift from digitization to dLeverage during the next four years.

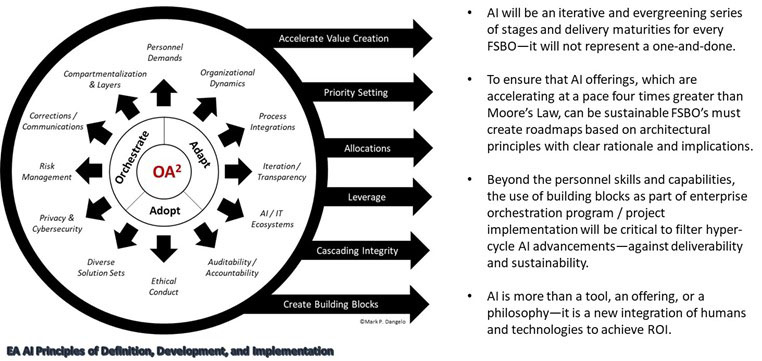

The two AI building blocks above when assessed and merged into the day-to-day production ready offerings, set the demands for the third pillar of integrated hyper accelerated solution sets (of intelligently capable applications). What I am referring to is not a vendor solution. It is not a methodology. It is a set of AI principles and filters that deliver the rationale and implications of definition, development, and implementation with human capability—the checks, balances, and operating constructs that make AI profitable for FSBOs. AI sustainability and iteration capability demands conformance not to one-off vendor solutions or a patchwork of digital strategies, but to a cohesive and transparent framework of AI maturity, which allows the stepwise growth of offerings to consumers and for internal operational efficiencies.

The following diagram provides a macro visual on the segments and challenges for FSBO leadership in this time of AI excitement and promise (i.e., the hype phase).

What this model above begins to establish is that the ability of AI will likely outdistance our FSBO organizations as we are viewing their implementation like a traditional IT system, application, or hardware improvements. AI represents a quantum shift that underneath it requires a set of robust operating procedures which many, many FSBO’s and lenders today do not possess.

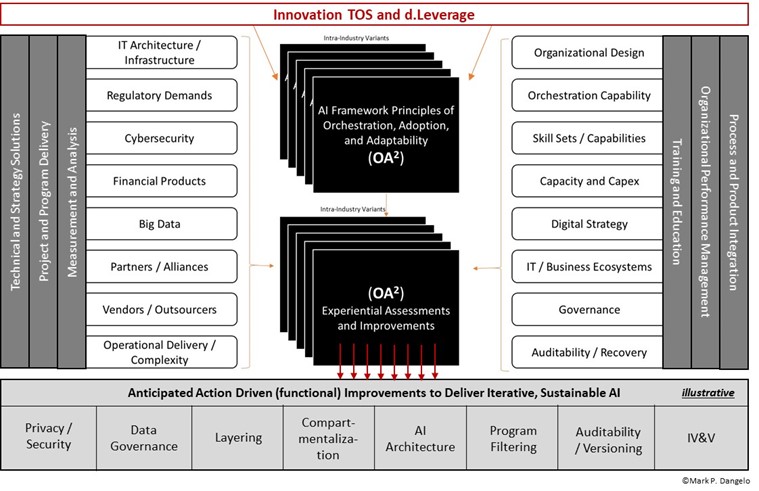

Yet, this is the opportunity for AI within FSBOs. To move an industry to the use of intelligent, learning solutions in conjunction with highly skilled employees to arrive at a customer delivery offering, which is competitively distinctive and defensible, will be a critical corporate goal in 2021 through 2025. What we will likely witness before the end of 2021 (timed with the rapid rise of regulatory burdens) are segmentations and components of, for lack of a better term, an AI maturity model that will be used by FSBO’s to filter solutions, and to proactively guide deployments to gain the greatest profitability and sustainability. The demand for an AI maturity model is driven by existing offerings (dLeverage and Innovation TOS) resulting in a robust model which provides an experiential definition, planning, and implementation assistance that is both repeatable and iterative.

Why does AI need this? Shouldn’t we just treat FSBO AI like any other application? The following diagram shows just the tip of complexity that comes with FSBO AI installations. For many medium to smaller FSBOs and lenders the challenge will be not on the organic definition and delivery of all functions identified below, but who will be partners for orchestration success—not vendors who will take our orders. And yes, these boxes of functionality and operating excellence will be in every FSBO that survives the AI disruption—not just those who ignore them and hope for the best.

For FSBOs without a comprehensive IT department disciplined in proactive architecture and infrastructure management, the urgency for 2021 will be deciding who will aid them with their assessments of baselines, creating future plans, devising roadmaps, and undertaking reskilling efforts to ride the AI wave into the next financial growth cycle (i.e., think of this as the next financial services supply chain).

For FSBOs, they must turn down politics in favor of innovation and entrepreneurship implications in 2021—as AI represents a disruptive innovation shift not witnessed since the late 1990’s. These distractions of daily chaos and positioning divert FSBOs’ focus from a real threat facing their conduct, systems, privacy, profitability and security—ethical, sustainable AI implementations.

Without a framework and maturity model to properly vet and prepare for AI, who in our industry or enterprise will provide the leadership to move forward? Can FSBOs and their associations, train AI to understand the innovation singularity that comes with its delivery? What happens when our AI decisions across cascading intelligent systems make decisions that financially harm investors or customers—or our own enterprise? Who has the accountability and audit responsibility to provide the governance for “thinking” systems and machines, which are growing in leaps and bounds?

This is why a maturity framework is demanded. This is why AI holds much promise—and unattributed risks. This is why we need to recognize our potential rationale and implications—or we risk our brands. AI will come broadly into FSBOs—are we ready for it? AI will grow, but will FSBOs, your FSBO, grow your cascading AI solution sets with sustainability, ethical conduct and profitability? Welcome to the Fourth Industrial Revolution.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)