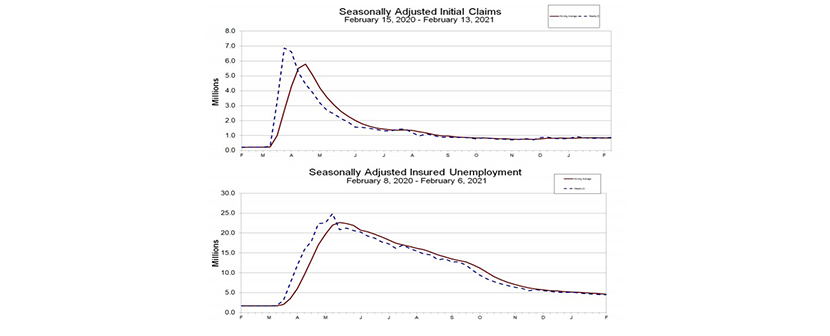

Initial Claims, Continued Claims Remain Elevated

Initial claims for unemployment insurance jumped by nearly 13,000 last week, while the previous week’s claims revised up by 55,000–a pointed reminder of the uneven pace of the country’s economic recovery.

The Labor Department reported for the week ending February 13, the advance figure for seasonally adjusted initial claims rose to 861,000, an increase of 13,000 from the previous week’s revised level. Additionally, the previous week’s level was revised up by 55,000 from 793,000 to 848,000. The four-week moving average fell to 833,250, a decrease of 3,500 from the previous week’s revised average.

The report said the advance seasonally adjusted insured unemployment rate held steady at 3.2 percent for the week ending February 6. The advance number for seasonally adjusted insured unemployment during the week ending February 6 fell to 4,494,000, a decrease of 64,000 from the previous week’s revised level. The previous week’s level was revised up 13,000 from 4,545,000 to 4,558,000. The four-week moving average fell to 4,632,000, a decrease of 120,250 from the previous week’s revised average.

The report said the total number of continued weeks claimed for benefits in all programs for the week ending January 30 fell to 18,340,161, a decrease of 1,325,567 from the previous week. Labor reported 2,118,115 weekly claims filed for benefits in all programs in the comparable week in 2020.

The report said the highest insured unemployment rates in the week ending January 30 were in the Virgin Islands (6.6), Alaska (6.4), Pennsylvania (6.4), Rhode Island (6.1), Nevada (6.0), Connecticut (5.3), Illinois (5.1), New York (5.1), New Mexico

(5.0) and Massachusetts (4.9). The largest increases in initial claims for the week ending February 6 were in Ohio (+92,667), California (+28,688), Georgia (+5,171), Mississippi (+3,796) and Colorado (+3,045), while the largest decreases were in Florida (-47,430), New York (-17,407), Maryland (-16,585), Kansas (-12,376) and Arizona (-7,478).

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the modest increase in jobless claims, on top of a hefty upward revision to the previous week’s data, suggests the labor market’s recovery continues to tread water.

“While claims figures the next few weeks will likely be distorted by recent weather events, we look for the trend to improve more materially over March,” House said. “Next week’s claims figures are likely to be suppressed by the unusually harsh winter weather much of the country is dealing with, but that generates the potential for a pop in claims the following week.