Despite January Pullback, Housing Starts Remain Strong

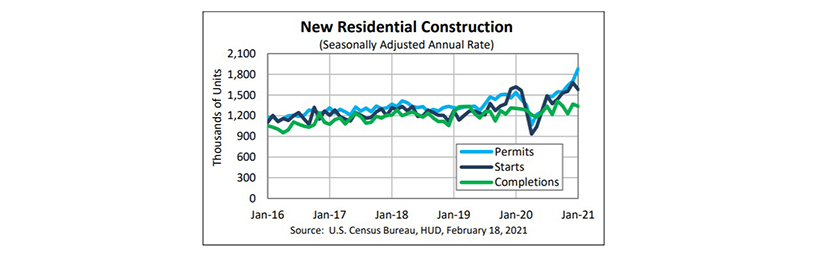

After a terrific December, January housing starts, as expected, fell back a bit but maintained a strong pace, HUD and the Census Bureau reported yesterday.

The report said privately owned housing starts in January fell to a seasonally adjusted annual rate of 1,580,000, 6 percent lower than the revised December estimate of 1,680,000 and 2.3 percent lower than a year ago (1,617,000). Single-family housing starts in January fell to 1,162,000; 12.2 percent lower than the revised December figure of 1,323,000. The January rate for units in buildings with five units or more, however, jumped to 402,000, 16.2 percent higher than December (346,000) but 35.1 percent lower than a year ago.

Regionally, only the Northeast saw improvement from December. Starts in the Northeast increased by 2.3 percent in January, seasonally annually adjusted, to 134,000 units from 131,000 units in December but fell by 38.2 percent from a year ago. In the South, starts fell by 2.5 percent to 829,000 units in January from 850,000 in December but improved by 4.7 percent from a year ago.

In the West, starts fell by 11.4 percent in January, seasonally annually adjusted, to 396,000 units from 447,000 units in December and fell by 9.2 percent from a year ago. In the Midwest, tarts fell by 12.3 percent in January to 221,000 units from 252,000 units in December but improved by 28.5 percent from a year ago.

“There is little reason to worry about January’s housing starts decline,” said Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “All the drop was in single-family starts, which is also where much of the recent strength has been. Apparently, there was a rush to get homes started in December, when the weather was unseasonably mild. Builders may have also held off from starting some projects because of the spike in lumber costs.”

Vitner said January’s 6 percent drop in housing starts “looks to be nothing more than some payback for the exceptionally strong numbers put up toward the end of 2020. Home building remains one of the strongest parts of the economy, with overall starts remaining 14.5% above their 2020 totals, even after January’s 6% drop. More succinctly, if housing starts were to remain at January’s level for the entire year, housing starts would rise 14.5%.”

Vitner added home building should get some boost from re-opening of economies in the Northeast and California this spring, “with the latter providing the more significant boost.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said housing market fundamentals offer optimism as winter inches into spring.

“Strong buyer demand lifted builder sentiment in the February survey, after declines in December and January,” Kushi said. “Low rates and the ongoing wave of millennial demand for homes, continue to boost demand and builders are responding.”

Kushi noted builders still face several supply-side headwinds, including high costs for materials, such as lumber (which set a price record in mid-February), a dearth of affordable lots and costly regulations. “These headwinds could slow home-building momentum in the months to come,” she said. “The devastating winter storm Uri will likely result in a temporary slowdown in building in Texas—something to watch in future reports.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said despite the pullback in single-family starts, the pace of construction continues to be strong, and was similar to the pace of October and November.

“We believe tight inventories of existing homes for sale and continued interest in suburban locations by many buyers bode well for new single-family construction going forward,” Duncan said. “That said, mortgage rates are no longer declining, and we believe homebuilders are near their short-term capacity constraints. Comparative softness in the starts measure is partially due to the ‘catch up’ phase from the second half of last year subsiding. In part due to COVID-related shutdowns last spring, the pace of starts outpaced the normal relationship to total homes under construction. Now a more normal balance is occurring.”

The report said privately owned housing units authorized by building permits in January rose to a seasonally adjusted annual rate of 1,881,000, 10.4 percent higher than the revised December rate of 1,704,000 and 22.5 percent higher than a year ago (1,536,000). Single-family authorizations in January rose to 1,269,000; 3.8 percent higher than the revised December figure of 1,223,000. Authorizations of units in buildings with five units or more rose to 557,000 in January, up by 28 percent from December and up by nearly 8 percent from a year ago.

“Permits rose for both single-family homes and multifamily projects, signaling the housing rebound still has plenty of forward momentum,” Vitner said.

HUD/Census said privately owned housing completions in January fell to a seasonally adjusted annual rate of 1,336,000, 2.3 percent lower than the revised December estimate of 1,368,000, but 2.4 percent higher than a year ago (1,305,000). Single-family housing completions in January rose to1,036,000, 10.0 percent higher than the revised December rate of 942,000. The January rate for units in buildings with five units or more fell to 296,000, down by 28.3 percent from December and down by nearly 24 percent from a year ago.