Mark P. Dangelo: Foretelling the Stories of ‘Ghosts of Yet to Come’ in 2022

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

In the world of digital transformation everyone wants to tell you a “story”—about their effort, the customer drivers, the results achieved, the clash of culture, or the chaos that ensued. The story can be uplifting regarding the goals and metrics achieved, or often it is about the lessons learned and why you should learn from their initiatives and fatal missteps. It is this latter category that seems to captive enterprise leadership—like people who slow down on the freeway to stare at the carnage.

While I don’t have a crystal ball or magic potion of foresight, like you I contemplate what 2022 will hold for financial services firms seeking profitability, market dominance, niche defensibility, or a diamond-in-the-rough value proposition.

Will the 2022 story be about a Federal Reserve tightening to combat inflation (which they said a year ago was only a quarterly aberration)? Will the story become one surrounding stakeholder capitalism forcing board of directors into new ESG (environmental, social and governance) decisions and divestitures? Will the consumer credit binge that rose during this Covid era finally meet the realities of MMT (modern monetary theory) and upside-down debt to revenue consequences? As M&A and divesture actions top $4 trillion in 2022, will financial services give birth to new miracles of operational hope to stem market commoditization?

Additionally, will machine learning and AI reach operational expectations thereby reducing staffing shortages, skill voids, security and privacy breaches, and multi-level risk mitigation? Or perhaps another closer to home, will the housing bubble be pierced resurrecting ghosts of Christmas past—and the vast fallout of markets, companies, and technologies? Finally, in an era of regulatory compliance and political polarization, what extremes will be presented and solidified with mid-term elections less than 11 months away? In summary, will our firms and our teams be part of these stories—or interested onlookers reacting to the consequences?

Many stories, many potential outcomes, none of it yet written. However, for our purposes, storytelling across leadership articles and prescriptive methods is about following a narrative which has been executed across challenges that are known—but none of the story threads above have outcomes. What about the unknowns contained within these stories and the hidden consequences interconnected across each? How do (or will) these story lessons transfer from what is familiar to the unfamiliar?

The problem with management and leadership prescriptions, much like our last 24 months dealing with Covid, is that the accepted playbooks of how to eliminate challenges (and emulate those who were successful) don’t work as advertised—there must be alternatives that are deployed. As we conclude this three part 2022-2023 c-level article series on new avenues and framework alternatives, we begin with a recast and end with a digital doppelganger.

Using the Familiar to Internalize the Unfamiliar

When it comes to innovative solutions or even incremental improvements, organizational cultures continually to react positively when they are shown how to adopt and adapt innovational ideas and technological solutions using what is familiar to them. Think of this as adaptative organizational change techniques applied to innovations.

Moreover, with advancements in process automation—robotics (e.g., RPA), machine learning, augmented reality and artificial intelligence—personnel, joint ventures, software, cloud vendors and even outsourcers are under extreme pressure to positively determine how to continually change against adoption cycles that are now measured in weeks, not years. Gone are the serialized approaches of software requirements, coding and testing—replaced with #agile creation, no-code / low-code development, #cloud provisioning, and continual #iteration against rising data variables captured across data lakes and warehouses.

For leadership, the #playbooks of emulation offer declining efficacy especially from their highly paid strategy and technology advisors who themselves are struggling to adapt to narratives they can no longer dominate. The #serialization of business models and product solutions now demands layers of innovation, #encapsulated building blocks, and an #orchestration of products and services across an organizational culture that is simultaneously static and dynamic. The variability of market and offering assembly creates conflict, uncertain partnerships, heavy budget burdens and transitory stepwise offerings that for mature industries (e.g., financial services) represent a dialogue analogy between Scrooge and Jacob Marley.

A key event sequence that will play out for financial services institutions in 2022-2023 is within the M&A space that once was dominated by acquisition to aid with (non-organic) growth. While financial services institutions continue to undergo consolidation with only 4,600 FDIC brands left in 2022 (down from 13,600 institutions in 1985), the buyers and those seeking carve outs represent a new breed of acquirers—FinTech, private equity, retailers, and most recently SPACs. As financial products suffer disintermediation of their markets by innovations that reduce the need for traditional brands (and their methods and processes), the playbooks for M&A digital demands in an age of transformation becomes out of phase with the next generation of these acquirers.

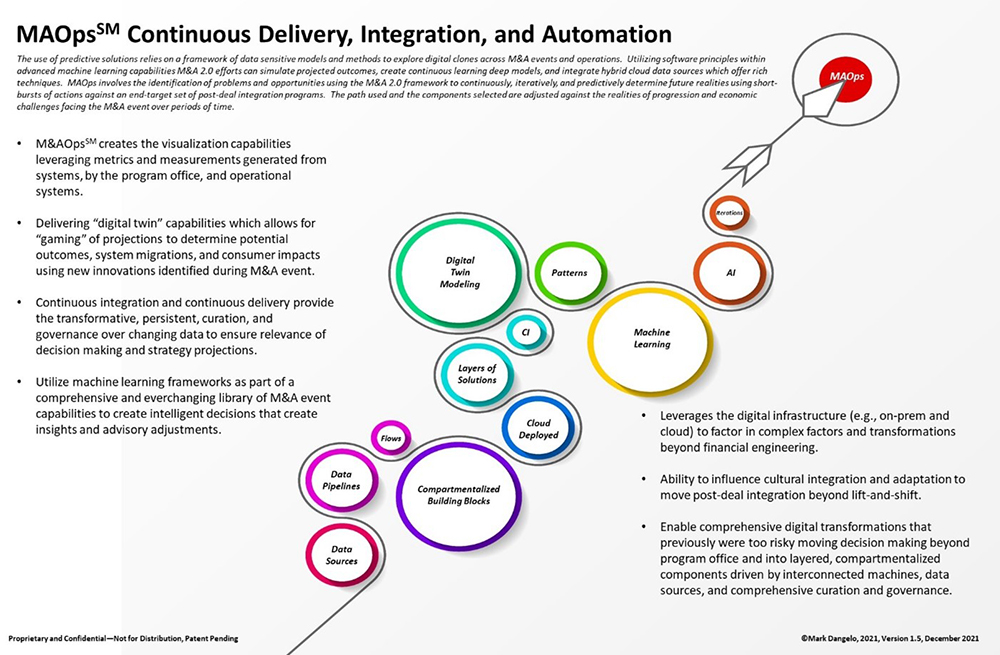

An example of using the familiar to guide the unfamiliar (i.e., in this case creation of a MAOpsSM to leverage DevOps principles for M&A events shown below) results in a framework for M&A events that is consistent, repeatable, and targeted to achieve synergies booked against timeboxed sprints for achieving results, organization change, and innovational transference. Across FSI, the keys for c-levels in 2022 will be to arrive at adaptable frameworks of delivery that represent phase shifts, but which can be related using the concepts of the familiar (e.g., DevOps, MLOps).

The fundamental caveat of using the familiar to adopt the unfamiliar surrounds making the new “like the old.” Meaning, to adopt innovation, leaders and their transformation teams fail to revolutionize processes, incorporate new skills and methods, and more importantly using the innovation to encase the old, resulting in an inefficient implementation where the innovation fail to achieve ROI, customer acceptance, and worse ingrain new risks and limitations that hinder future growth and change. Therefore, the use of agile leadership delivered in stepwise iterations is so critical—it weeds out the resistance to accept, “the more things change the more they remain the same” principle of management and FSI cultures.

Asking “What-if” With Digital Twins

The idea of a “digital doppelganger” or digital twin has been around since the 1950s. It grew in prominence during the 1990’s during the exposure of the management tools surrounding process reengineering and growing software development capabilities. Most recently digital twin methods have been resurrected and placed on a pedestal to solve the global supply chain crisis’s impacting current product availability and skyrocketing inflation which last month alone approached 7%.

Again, using the familiar to understand the unfamiliar, for digital transformation solutions the use of “what-if” doppelgangers allow progressive leadership comfortable with digital analytics and projections to ascertain the impacts of thousands of variables on desired outcomes. For example, they can use game theory coupled with traditional simulation methods against digital data stores that would have been too expensive, too complex, and too unpredictable to achieve just 3 years ago. With more vendors now incorporating comprehensive data hubs to conduct analytics and intelligence manipulation, the integration of these digital twins can be accomplished without incurring the cost and time of say the Webb Telescope development and launch.

With the rapid acceptance of cloud capabilities, the creation of digital twins has been advanced by the sheer volume of granular offerings launched across Amazon’s #AWS, Microsoft’s #Azure, and IBM’s #Kubernetes. While these offerings grow both with native and ported applications, additional vendors and startups are pushing the application and microservice capabilities of these vast platforms enabling the delivery of digital twins that can be run concurrently against deployed infrastructure to identify limitations or failures before they are likely to happen.

The use of digital twins across initiatives such as cloud infrastructure deployment and M&A events (i.e., pre-deal, deal, post-merger, carve-outs, model replication) allows innovative leaders to not only anticipate results, but to explore alternative solutions against varied risks and market conditions that previously could not be achieved. Additionally, digital twins used as part of a digital transformation creates a D2I2 (i.e., define, develop, implement, iterate) framework that captures time and solution events analogous to supply chain management disciplines.

In 2022, these practices will be critical core competencies for FSI leadership seeking to understand the growing array of options and solutions that impact upstream and downstream offerings and relationships (e.g., Metaverse, provisioning, customers, financial instruments). The fundamental opportunity for FSI leaders across the spectrum of untold future stories resides with the use of unfamiliar innovation using familiar solutions to address growing unknown unknowns inside and outside the enterprise.

Across banking leadership, the risks of leaping into the unknowns grows with each passing non-traditional competitors who target existing financial customers with new options. Even the once profitable and elitist investment bankers (IB) are not immune to innovational impacts on their value proposition and role within the financial supply chains—as private equity institutions rapidly bypass their services by going directly to investors and potential candidates thereby eliminating IB fees and “expert” advice along with fragmentation of functionality and limited accountability.

Indeed, as in the Christmas Carol, if Jacob Marley represents innovational digital demands, Scrooge (i.e., FSI) can dismiss the ghostly visit as a “You may be an undigested bit of beef, a blot of mustard, a crumb of cheese, a fragment of underdone potato. There’s more of gravy than of grave about you, whatever you are!” For banking leadership in 2022-2023 to discount the growing threats to nearly every functions across financial services, they may find themselves as one of the 240-280 yearly brands lost to time—a note in a graveyard of firms gone before them.

Moving forward, there is no option of going back “to the good old days.”

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)