MBA November Builder Applications Survey Down 3% From October; 2.2% from Year Ago; Home Builder Sentiment Up

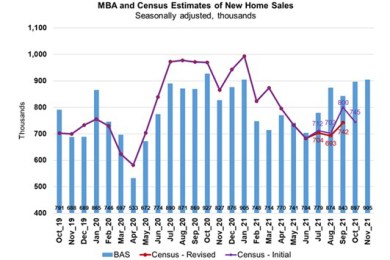

Mortgage applications for new home purchases fell in November by 3 percent from October and by 2.2 percent from a year ago, the Mortgage Bankers Association reported Thursday.

Fed Moves Up Timetables

The Federal Open Market Committee on Wednesday said it would speed up its tapering of agency mortgage-backed securities and hinted its timetable for raising the federal funds rate could move up as well.

MBA: 3Q Holdings of Commercial/Multifamily Mortgage Debt Increase

Commercial/multifamily mortgage debt outstanding increased by $64.8 billion (1.6 percent) in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

MISMO Launches Updated Commercial Green Utility Dataset

MISMO®, the real estate finance industry standards organization, announced availability of its updated Commercial Green Utility Dataset standard.

Federal Agencies Make No Changes to QRM Definition

Six federal agencies issued notice on Tuesday that they will not modify their current definition of a Qualified Residential Mortgage.