Home Price Growth Continues to Slow (But Not by Much)

The good news for home buyers: home price growth continued to decelerate, according to reports last week from S&P Down Jones Indices and the Federal Housing Finance Agency. The bad news: home price growth maintains double-digit percentage annual growth that appears likely to continue well into 2022.

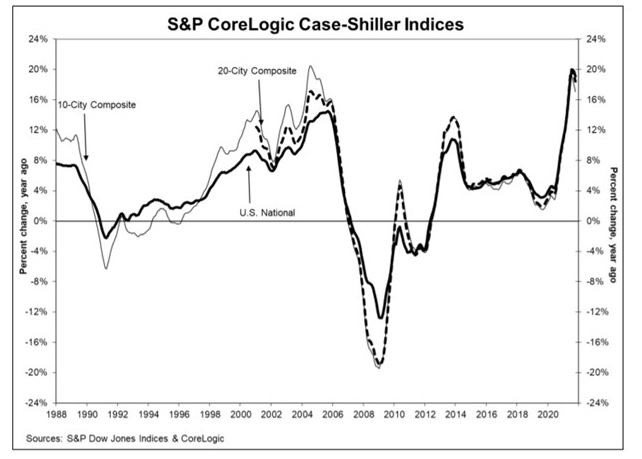

The S&P CoreLogic Case-Shiller Indices reported a 19.1% annual gain in October, down from 19.7% in September. The 10-City Composite annual increase came in at 17.1%, down from 17.9% in the previous month. The 20-City Composite posted an 18.4% year-over-year gain, down from 19.1% in the previous month.

Phoenix again led with a 32.3% year-over-year price increase, followed by Tampa at 28.1% and Miami at 25.7%. Six of the 20 cities reported higher price increases in the year ending October from September.

Month over month, before seasonal adjustment, the National Index posted an 0.8% increase in October, while the 10-City and 20-City Composites each posted increases of 0.8%. After seasonal adjustment, the National Index posted a month-over-month increase of 1.0%, while the 10-City and 20-City Composites posted increases of 0.8% and 0.9%, respectively. Eighteen of the 20 cities reported increases before seasonal adjustments while all 20 cities reported increases after seasonal adjustments.

“In October 2021, U.S. home prices moved substantially higher, but at a decelerating rate,” said Craig J. Lazzara, Managing Director with S&P DJI. “October’s gains were below September’s, and September’s gains were below August’s.

“While the U.S. S&P CoreLogic Case-Shiller continued to slow in October, up 19.1% but down from 20% peak annual gain two months prior, home prices are still increasing at double-digit rates in all metros reported by the index,” said Selma Happ, Deputy Chief Economist with CoreLogic, Irvine, Calif. “The slowing of home prices is most notable in colder and more expensive areas, as well as middle-tier priced homes where homebuyers may have less wiggle room in their budgets. Low-tier priced homes are still in higher demand as entry-level buyers and investors continue to compete for the very limited supply. This suggests that 2022 will be another year of strong home price growth, averaging 7% for the year — which is slower than 2021 but still above the 5% average increase seen between 2010 and 2020.”

The report said as of October, average home prices for the MSAs within the 10-City and 20-City Composites are exceeding their winter 2007 levels.

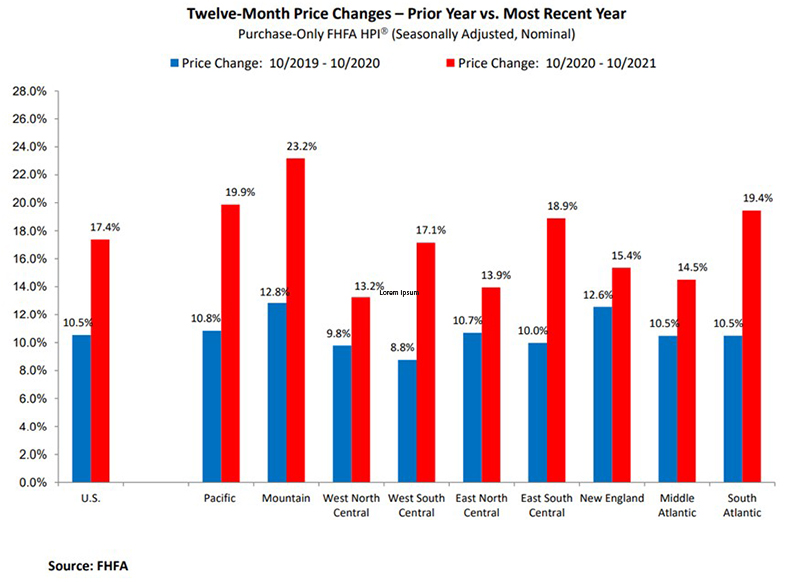

In a separate report, the Federal Housing Finance Agency’s monthly House Price Index reported home prices rose nationwide in October, up 1.1 percent from September. House prices rose 17.4 percent from October 2020 to October 2021. The previously reported 0.9 percent price change for September 2021 remained unchanged.

For the nine census divisions, seasonally adjusted monthly house price changes from September to October ranged from -0.3 percent in the New England division to +1.7 percent in the East South Central division. The 12-month changes ranged from +13.2 percent in the West North Central division to +23.2 percent in the Mountain division.

“House price levels continue to rise but the rapid pace is curtailing through October,” said Will Doerner, Supervisory Economist in FHFA’s Division of Research and Statistics. “The large market appreciations seen this spring peaked in July and have been cooling this fall with annual trends slowing over the last four consecutive months.”