MBA Year-End Housing Market Roundup Dec. 24, 2021

Good morning! As we prepare to take a break over the holidays, here’s a wrap-up of housing and economic reports that came across the MBA NewsLink desk this week:

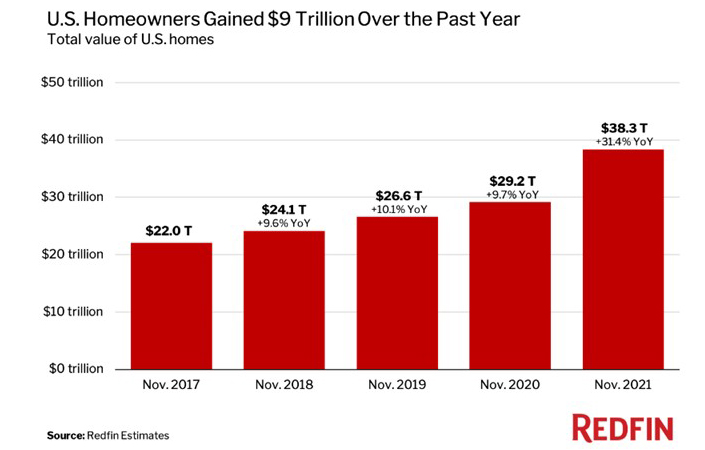

U.S. Homeowners Gained $9 Trillion Over Past Year

U.S. homeowners gained $9.1 trillion of housing value over the past year as housing prices continued to climb amid a severe shortage of homes for sale, according to a new report from Redfin, Seattle.

The report said home values surged 31.4% year over year to $38.3 trillion last month, far outpacing the 9.7% ($2.6 trillion) annual increase seen the prior November.

Redfin Chief Economist Daryl Fairweather said home prices have skyrocketed during the pandemic as record-low mortgage rates, remote work and a soaring stock market fueled a swell in homebuyer demand amid an ongoing housing shortage. November marked the 16th-straight month of double-digit price gains, while the number of homes for sale sunk to a record low.

“The surge in housing values during the pandemic has widened the gap between homeowners and renters in America,” Fairweather said. “Homeowners have seen their wealth increase significantly over the past year, while renters have missed out on those gains and are now grappling with rent inflation.

Fairweather noted the silver lining for homeowners is that housing values didn’t just climb in large affluent cities. “Homeowners in rural America, who don’t normally see substantial home-value increases, also reaped the benefits of a booming housing market,” she said.

Indeed, the report said the value of rural homes rose 46.2% year over year to $4.9 trillion in November. By comparison, the value of urban homes increased 31.3% to $8 trillion and the value of suburban homes climbed 25.9% to $24.1 trillion. The report noted while cities have been bouncing back from a coronavirus slowdown, rural areas remain more popular than they were before the pandemic as remote workers continue to seek extra space and relative affordability.

Redfin said the value of condos climbed 42.7% year over year to $5.1 trillion in November. By comparison, the value of single-family homes rose 30.1% to $32 trillion and the value of townhouses increased 20.6% to $1.2 trillion. The report noted the pandemic hit the condo market hard in 2020, with scores of Americans exchanging cramped urban life and shared amenities for bigger homes in the suburbs and rural areas. But as lockdown restrictions eased and the initial shock of the pandemic faded, condos and city life began to make a comeback.

The report said homes in Austin, Texas surged 48.1% year over year to $389.5 billion in November—the largest gain among the 50 most populous U.S. metropolitan areas, followed by Jacksonville, Fla. (39.9%) and Phoenix (38.3%). Tampa, Fla., and Riverside, Calif., rounded out the top five, with increases of 36% and 32%, respectively. Homebuyers have flocked to Sun Belt states during the pandemic as remote work has allowed them to prioritize affordability over proximity to the office. Austin, Phoenix and Tampa have consistently been among the hottest spots for homebuyers looking to relocate during the pandemic.

With home prices surging across the Sun Belt, Fairweather predicts homebuyers will increasingly start moving to more affordable northern cities such as Indianapolis, Columbus, Ohio and Harrisburg, Pa.

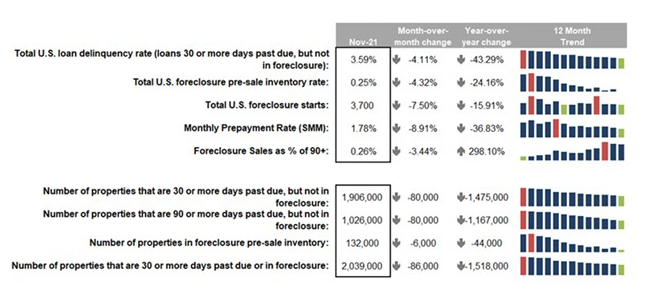

Black Knight: Mortgage Delinquencies Continue Steady Improvement

Black Knight, Jacksonville, Fla., said mortgage delinquencies and foreclosures continued to drop, with active foreclosures falling to another record low.

The company’s First Look Mortgage Monitor reported the national delinquency rate saw another month of steady improvement, with November’s 4.1% monthly decline matching the 18-month average rate of reduction. But despite serious delinquencies (loans 90+ days past due but not in foreclosure) falling another 80,000 from October, more than 1 million such delinquencies remain, 2.5 times more than at the start of the pandemic.

The report said both foreclosure starts (3,700) and active foreclosure inventory (132,000) hit record lows in November as borrowers continue to work through available forbearance and loss mitigation options. Black Knight reported more than 800,000 forbearance exits over the past 60 days, although nearly 560,000 homeowners remain in post-forbearance loss mitigation

Prepayment activity fell by 8.9% in November to hit its lowest level in 22 months, as rising 30-year rates continue to put downward pressure on refinance volumes.

States with the highest non-current percentage rates were Louisiana, Mississippi, West Virginia, Oklahoma and Alabama; states with the lowest non-current percentage rates were Idaho, Colorado, Washington, California and Utah.

States with the highest percentage of 90-plus days delinquences were Louisiana, Mississippi, Oklahoma, Maryland and Arkansas.

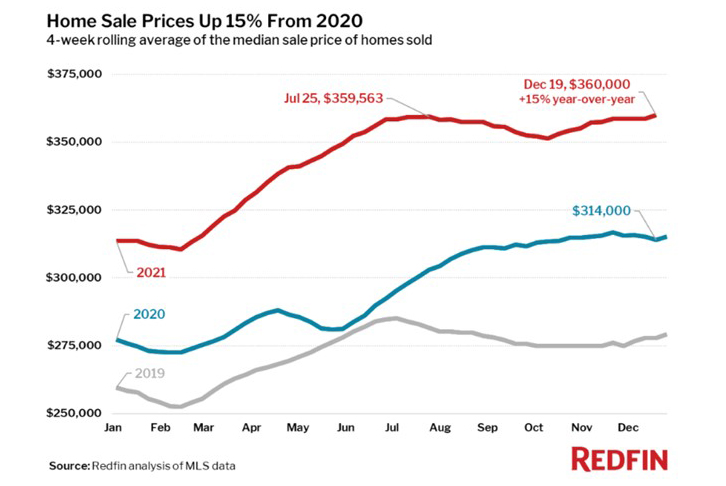

Redfin: Median Home Sales, Inventories Set Records

Redfin also reported the median home sale price rose 15% year over year to a record-high $360,500 as the number of homes for sale fell to a record low.

“As the number of homes for sale drops to a new all-time low every week, homebuyers have a sense that the well is running dry,” Fairweather said. “Fewer homes are selling because of a lack of supply, while demand remains strong. That’s why home prices continue to climb higher and higher. But once mortgage rates increase in 2022, I expect the rate of price growth to slow down significantly.”

For the four-week period ending December 19, Redfin reported the median asking price of newly listed homes increased 14% year over year to $347,475, up 29% from 2019. But New listings of homes for sale fell 9% from a year earlier. Active listings fell 26% year over year to record low, and were down 45% from 2019.

The report also said 31% of homes that went under contract had an accepted offer within one week of hitting the market, up from 26% a year earlier and 16% in 2019. Homes that sold were on the market for a median of 26 days, down from 32 days a year earlier and 48 days in 2019. Forty-three percent of homes sold above list price, up from 34% a year earlier and 20% in 2019.

In a separate report, Clear Capital, Reno, Nev., said national quarter-over-quarter home price growth rose to 3.9%. The Clear Capital December Home Data Index Market Report said top-performing metros for December were Raleigh, N.C. (8.4%), Tampa, Fla. (8.4%) and Miami (7.6%); lowest-performing metros were Milwaukee (-0.2%), Rochester, N.Y. (0.4%) and Minneapolis (0.6%).

RE/MAX: Home Prices Drop at Fastest Pace Since Pandemic

Meanwhile, RE/MAX, Denver, issued its monthly National Housing Report, showing in some areas, homebuyers finally saw some welcome relief on home prices.

The report said November’s median sales price dropped 2.9% to $330,000 – the largest monthly decline since the pandemic began. It wasn’t the only metric to surprise in November 2021. While the month generally followed seasonal trends such as cooling home sales, several records – including the fewest average number of days homes were listed before selling – were also set.

The report said homes continued to sell at a fast clip in Nashville, Omaha and Cincinnati – evidence of the continuation of the strong housing market seen nationally this past year. But the low months’ supply of inventory—down more than 30% year over year—also shows just how frenzied this housing market remains, said RE/MAX President Nick Bailey.

“The market is roaring along, with only half the seasonal slowdown we typically see from October to November,” Bailey said. “The small drop in prices is great news for buyers, and it could be an early sign of some balance coming back into the market. “The lack of available inventory continues to be a challenge, but 2021 has been a very strong year for home sales. That says a lot about the resiliency of the housing market and the importance of homeownership in people’s lives. With work flexibility, low interest rates, generational factors and continued high demand, we’re heading into 2022 with plenty of reasons to be optimistic.”

Despite declining month over month, November’s median home price was 11.9% higher than November 2020’s $295,000 and marks the 35th consecutive month that home prices have risen year over year. The median of all 51 metro Median Sales Prices fell to $330,000, down 2.9% from October but up 11.9% from November 2020. No metro areas saw a year-over-year decrease in median sales prices; 39 metro areas increased year-over-year by double-digit percentages, led by Phoenix at +27.2%, Salt Lake City at +25.3% and Boise, Idaho at +24.8%.

Average days on market for homes sold in November rose to 29, up two days from October, but down 8 days from the average a year ago.

The five-year average for October-to-November inventory showed a decline of 8.9%, slightly over half of the drop of 17.7% in November.