J.D. Power: Mortgage Servicers Get High Marks; Nonbanks Gain Traction

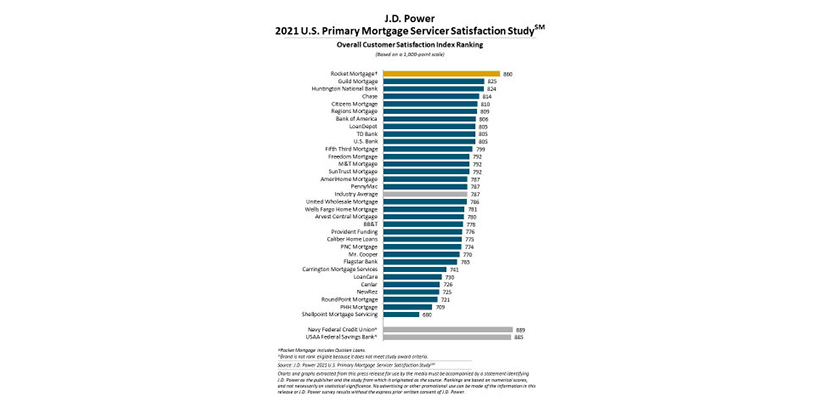

(Chart courtesy J.D. Power 2021 U.S. Primary Mortgage Servicer Satisfaction Survey.)

J.D. Power, Troy, Mich., said mortgage servicers earned high levels of customer satisfaction during the pandemic, but warned as loan forbearance programs come to an end and more normalized customer interactions resume, traditional banks are starting to lose their edge over non-bank lenders.

The company’s 2021 U.S. Primary Mortgage Servicer Satisfaction Study reported mortgage servicers increased overall satisfaction by a significant six points this year (on a 1,000-point scale) through a combination of relief efforts and quick pivots to digital solutions. Rocket Mortgage/Quicken Loans retained the top spot for customer satisfaction for an eighth consecutive year.

“Mortgage servicer satisfaction was buoyed by the industry’s response to the pandemic, with some of the biggest gains in customer satisfaction being driven by at-risk and moderate-risk customers who participated in forbearance programs,” said Jim Houston, director of consumer lending intelligence with J.D. Power. “However, as we look at post-pandemic customer behaviors and responses of low-risk customers, we see that lift in satisfaction may be short-lived. In fact, despite the attention on relief programs, nearly one-fifth of current mortgage customers have had no interaction with their servicer during the past year. Mortgage servicers will really need to up their customer engagement games as the marketplace stabilizes.”

Key survey findings:

—Bank-affiliated servicers started to lose their edge to non-banks: While overall satisfaction increased by six points this year, the bulk of that increase was driven by non-bank servicers, which saw a significant 17-point increase in satisfaction. Bank-affiliated servicers, which have historically outperformed non-banks by a large margin, gained just four points in satisfaction this year.

—Forbearance lift will not last long: Another key driver of increased customer satisfaction this year was the at-risk customer category. Overall satisfaction among at-risk customers increased by 15 points year over year, while satisfaction scores among low-risk customers declined by one point. Likewise, satisfaction was highest in the study among those customers who participated in forbearance programs (846). This compares to a score of 783 among those who never enrolled in one and 776 among customers who were previously enrolled in a program but are no longer enrolled.

—Banks get satisfaction lift from non-mortgage services: Higher overall satisfaction scores for bank-affiliated servicers were inflated by non-mortgage services. Satisfaction scores among customers who also used their servicer’s bank products were 55 points higher than among those who have mortgage-only relationships.

—Need evident to expand engagement on digital, self-service channels: While website usage increased by five percentage points this year, J.D. Power said there is still room for improvement with the online channel. Only 38% of customers said they found the desired information on their servicer’s website within the first two pages. When customers had to visit more than two pages, overall satisfaction declined by 55 points. Among customers who indicated they would switch lenders if given the opportunity their top reasons, in addition to better rates, were “better/improved customer service” and “easy access to help myself to information about my loan.”

–Rocket Mortgage (which includes Quicken Loans) was the highest-ranked mortgage servicer for an eighth consecutive year, with a score of 860. Guild Mortgage (825) ranked second and Huntington National Bank (824) ranked third.

The 2021 U.S. Primary Mortgage Servicer Satisfaction Study measures customer satisfaction with the mortgage servicing experience in five factors: customer interaction; communications; billing and payment process; escrow account administration; and new customer orientation. The study is based on responses from 8,507 customers who originated or refinanced more than 12 months ago. It was fielded from March through May. The survey can be accessed here.