BREAKING NEWS

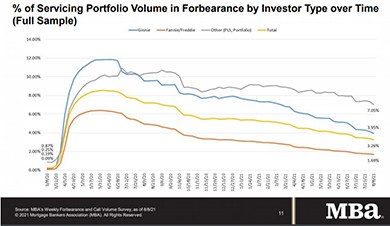

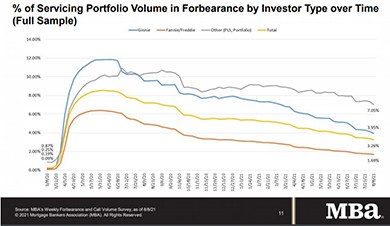

Loans in Forbearance Fall to 3.26% MBA Builder Applications Survey

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 14 basis points to 3.26% of servicers’ portfolio volume as of August 8 from 3.40% the previous week. MBA now estimates 1.6 million homeowners are in forbearance plans.

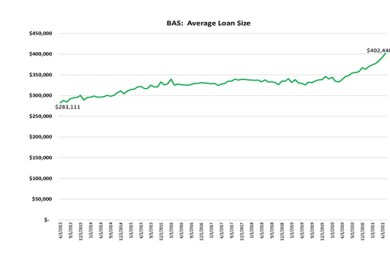

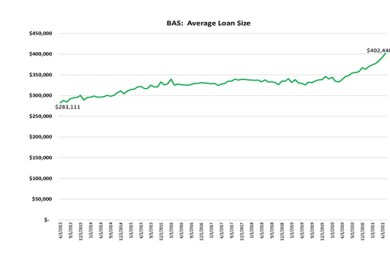

Mortgage applications for new home purchases decreased 27.4 percent compared to a year ago, the Mortgage Bankers Association Builder Application Survey reported.

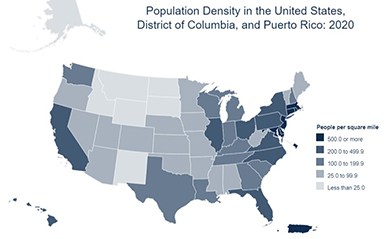

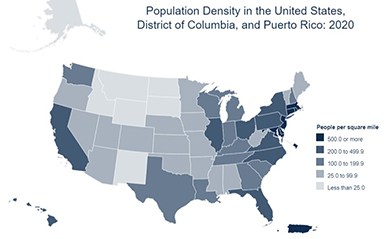

The Census Bureau last week released preliminary results from its 2020 Census, showing a United States in the midst of demographic transition.

STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa., upgraded their U.S. hotel sector forecast for 2021 but lowered their growth projections for 2022.

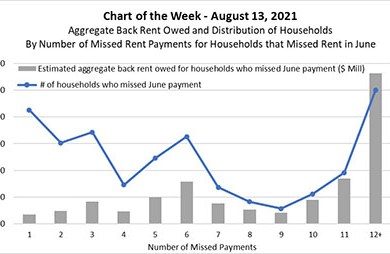

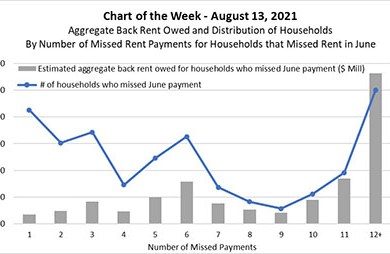

This week’s MBA Chart of the Week zeroes in on households who missed rental payments in June. The chart plots a) the distribution of those households by the number of payments they have missed since the onset of the pandemic; and b) an estimate of the aggregate dollar volume of back rent owed by those households.

The Federal Housing Finance Agency released reports providing the results of the 2020 and 2021 annual stress tests Fannie Mae and Freddie Mac under the Dodd-Frank Act.

JLL Income Property Trust, Chicago, acquired a 47 percent interest in a large single-family rental portfolio for $560 million.

M&A events in the Age of Industry 4.0 have moved beyond scale and into the digital clarity achieved by the combination of firms using curated data necessary to profit from vast ecosystems of financial products and services across channels and consumers. Financial and private equity firms that target and conduct due diligence solely on financial engineering will become footnotes in history.

As yet another extension of the nationwide pandemic eviction and foreclosure restrictions is put in place (at least for federally back mortgages), the mortgage industry is bracing for formidable challenges on a number of fronts.

MBA is proud to recognize its Premier and Select Associate Members and to thank them for their continued support of MBA and the real estate finance industry.

MBA is proud to recognize its Select Associate Members and to thank them for their continued support of MBA and the real estate finance industry.

Early Wednesday morning, the Senate voted along party lines to adopt a $3.5 trillion budget resolution framework for fiscal year 2022, another step toward the crafting of the actual tax provisions – including a possible minimum book tax that would impact mortgage servicing rights values – that will offset the cost of President Joe Biden’s broad infrastructure package.

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as Academy Award- and Presidential Medal of Freedom Award-winning actress Rita Moreno keynotes the mPower Luncheon on Tuesday, Oct. 19.