MBA Chart of the Week Aug. 9, 2021: Share of Monthly Forbearance Exits by Reason

According to MBA’s Weekly Forbearance and Call Volume Survey, the share of loans in forbearance dropped to 3.47 percent of servicers’ portfolio volume as of July 25, 2021, from a peak of 8.55 percent as of June 7, 2020. While the number of borrowers exiting forbearance has fluctuated from one month to the next, with the largest number of reported exits in July and October of last year, the post-forbearance outcomes for borrowers have differed.

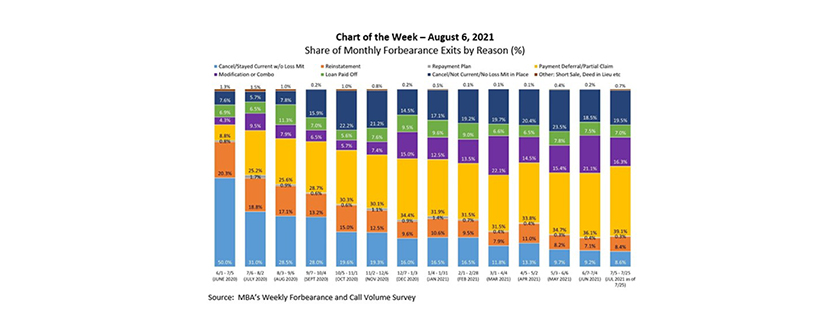

This week’s Chart of the Week shows the reasons for a forbearance exit, based on the cumulative monthly exits for the period from June 1, 2020, through July 25, 2021.

In the three earliest months of forbearance exit tracking (June-August 2020), the most prevalent reason for a forbearance exit were borrowers who continued to make their monthly payments during forbearance. These borrowers were likely using forbearance as an insurance policy of sorts, in the event of a household hardship that never came to pass or was quickly resolved. Another common reason for a forbearance exit during this early time period was reinstatement, in which past‐due amounts were paid back when exiting forbearance. Stimulus and unemployment checks, personal savings, and re-employment may have helped these borrowers who likely missed just a few payments.

Fast forward to the past three months of forbearance exits tracking (May-July 2021), MBA’s data show a substantial change in forbearance exit reasons. More forbearance exits resulted in either a loan deferral/partial claim, or a loan modification, or a combination of a loan modification and payment deferral, representing 55.4% of exits in July (as of July 25).

We continue to monitor the remaining reasons for forbearance exits, including loans paid off through either a refinance or home sale; repayment plans; short sales; deed in lieus or other reasons; and finally borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet. These borrowers may have not yet contacted their servicer to extend forbearance or to pursue alternatives to foreclosure, or may need to provide additional documentation to be placed into an appropriate loss mitigation solution.

During the period from June 2020 to July 2021, it is important to note that loss mitigation and workout options (loss mitigation waterfalls) have been periodically revised to offer borrowers additional or enhanced home retention and workout opportunities. For example, FHA recently announced additional measures to help struggling homeowners, including a COVID-19 Advance Loan Modification that requires only a signature from the borrower, which eliminates extensive documentation requirements.

As forbearance plans expire over the course of the next several months and foreclosure moratoria lift, we can expect many homeowners to take advantage of these options to remain in their homes and avoid a difficult foreclosure process.

For a detailed description of forbearance exits by reason data, click here. Marina Walsh (mwalsh@mba.org)